Submitted by Bilal Hafeez, Nomura’s global head of G10 FX strategy

I only just got round to reading the BIS quarterly report that came out last week. Below are the five sets of charts that stand out for me from the 152 page report:

- Share of BBB corporate bond issuers has risen in US and Europe since 2000. “In the United States, the increase took place mainly prior to the Great Financial Crisis (GFC). In Europe, it continued after the GFC. As of 2018, the share of corporate bond issuers rated BBB stood at about one third in the United States and at nearly half in Europe.” (p.12)

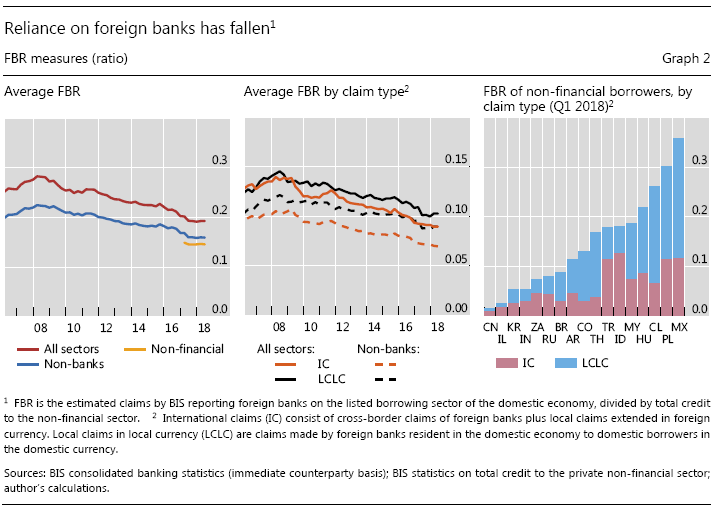

- After the GFC, average reliance on foreign bank credit steadily decreased from 28% of the total in Q3 2008 to 19% by Q2 2018. “This reduction reflects a stagnation in credit from foreign banks as well as an increase in credit from both domestic banks and non-bank creditors. In general, both international claims (IC) and local claims in local currencies (LCLC) reliance declined following the GFC, but IC dropped by more, indicating a relative increase in local currency borrowing from foreign banks (Graph 2, centre panel). The cross section shows substantial differences in foreign bank reliance among EMEs (Graph 2, right-hand panel). Mexico (0.36), Poland (0.30) and Chile (0.26) have the highest, while Israel (0.03) and China (0.02) have the lowest.” (page 20)

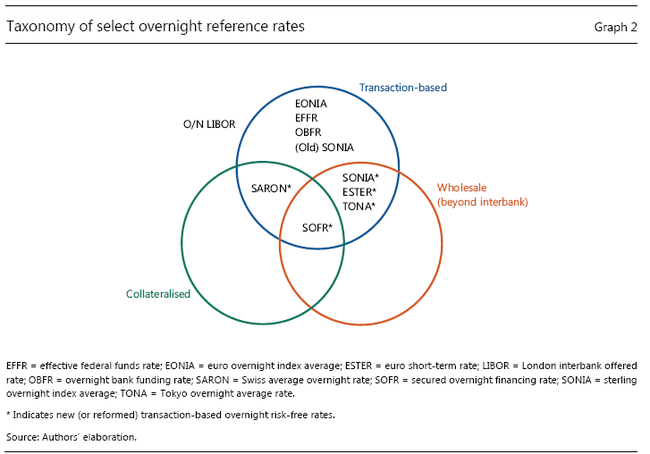

- Five of the largest currency areas have all moved to new overnight benchmarks. ”Graph 2 shows a classification of the old and new O/N reference rates based on key features, ie whether the rate (i) is transaction-based; (ii) is based on collateralised (secured) money market instruments; and (iii) reflects borrowing costs from wholesale non-bank counterparties. For ease of comparison, existing (or old) RFRs as well as O/N LIBOR are also shown. A major feature for all currencies, with the exception of the Swiss franc, is that the range of eligible transactions is no longer limited to interbank, and includes interest rates paid by banks to non-bank lenders. The United States and Switzerland have further opted to base the secured overnight financing rate (SOFR) and Swiss average overnight rate (SARON) on secured (repo) transactions” (Page 36)

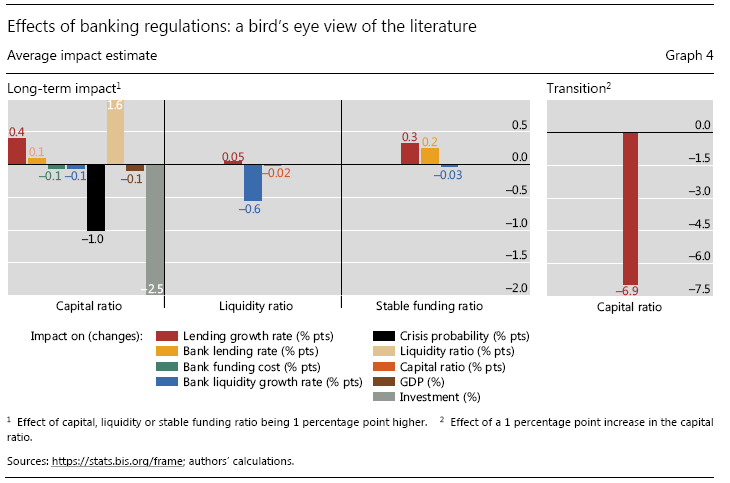

- No indication that raising bank liquidity or stable funding ratios reduces bank lending (Graph 4, lefthand panel, red and yellow bars). “Recent studies also find that if a bank has a higher capital ratio this tends to be accompanied by a higher liquidity ratio (beige bar). To the extent that holding more liquid assets is associated with more prudent behaviour, this finding is in line with the notion that banks tend to take less risk when they have more “skin in the game”. Studies also confirm that the effects during the transition to tighter regulation may be different from the impact once banks have reached the new standard. For example, a 1 percentage point higher capital ratio is found to have a positive effect on loan growth in the long term, but a negative effect during the transition (compare the red bars in the left- and right-hand panels of Graph 4).” (Page 60)

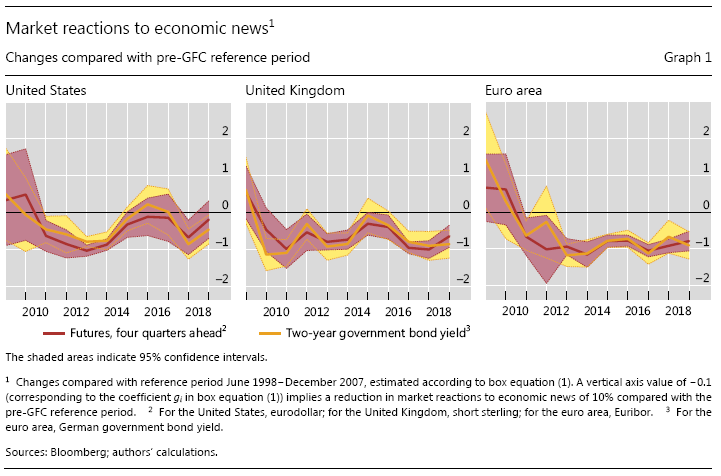

- Zero lower bound (and forward guidance) has dampened the response of short-term market interest rates to news after the GFC. “BIS’s Our empirical model produces estimates for changes in market reactions to news, relative to the pre-GFC period (June 1998−December 2007), which provides the baseline for “normal” market reactions. These changes are shown in Graph 1 for the US, UK and the euro area, where a value of −0.1 implies a reduction of 10% in market reactions to news, as compared with the average during the pre-GFC reference period. Interestingly, market reactions to macroeconomic news in both the United Kingdom and the euro area had already decreased significantly by 2012, when the ZLB was binding in those economies. …. For short horizons (two and four quarters ahead), a 10 percentage point increase in the ZLB probability nine months ahead is associated with a reduction of 7–13% in the responsiveness of market interest rates to economic news. For a longer horizon (eight quarters ahead), the ZLB probability has no significant effect.” (Page 87)

(Visited 8 times, 1 visits today)