Authored by Lance Roberts via RealInvestmentAdvice.com,

The “QE, Not QE” Rally Is On

Just recently, we released a study for our RIAPro Subscribers (30-Day Free Trial) on historical QE programs and what sectors, markets, and commodities perform best. (If you subscribe for a 30-day Free Trail you can read the entire report “An Investor’s Guide To QE-4.”)

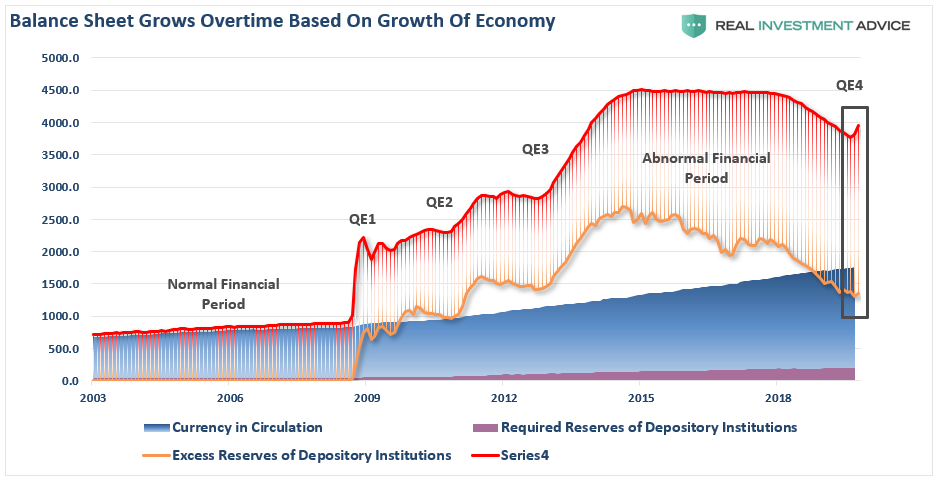

“On October 9, 2019, the Federal Reserve announced a resumption of quantitative easing (QE). Fed Chairman Jerome Powell went to great lengths to make sure he characterized the new operation as something different than QE. Like QE 1, 2, and 3, this new action involves a series of large asset purchases of Treasury securities conducted by the Fed. The action is designed to pump liquidity and reserves into the banking system.

Regardless of the nomenclature, what matters to investors is whether this new action will have an effect on asset prices similar to prior rounds of QE. For the remainder of this article, we refer to the latest action as QE 4.

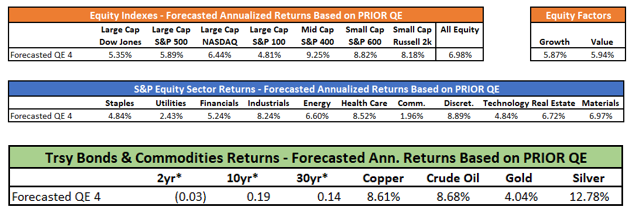

To quantify what a similar effect may mean, we start by examining the performance of various equity indexes, equity sectors, commodities, and yields during the three prior QE operations. We then normalize the data for the duration and amount of QE to project what QE 4 might hold in store for the assets.”

The following is one of the tables from article.

As you will notice, all major markets increased in value during QE-1, 2, and 3.

Since the market increased each time the Fed engaged in monetary programs, it should not be surprising investors now have a “Pavlovian” response to the Fed “ringing the bell.”

Over the last month, we have been discussing the end of the year rally which would be supported by both the Fed, and a “trade deal.”

This past week, as expected, headlines were floated which suggested that tariffs would be reduced in exchange for essentially nothing, This is precisely the case we laid out in September:

“Trump can set aside the last 20%, drop tariffs, and keep market access open, in exchange for China signing off on the 80% of the deal they already agreed to.

For Trump, he can spin a limited deal as a ‘win’ saying ‘China is caving to his tariffs’ and that he ‘will continue working to get the rest of the deal done.’ He will then quietly move on to another fight, which is the upcoming election, and never mention China again. His base will quickly forget the ‘trade war’ ever existed.

Kind of like that ‘Denuclearization deal’ with North Korea.”

We followed that in early October by laying out the case for the “trade deal” to push the markets to 3300:

“Assuming we are correct, and Trump does indeed ‘cave’ into China in mid-October to get a ‘small deal’ done, what does this mean for the market.

The most obvious impact, assuming all ‘tariffs’ are removed, would be a psychological ‘pop’ to the markets which, given that markets are already hovering near all-time highs, would suggest a rally into the end of the year.”

Then, just two week’s ago, as the Fed went into action:

“Clearly, the Fed is concerned about something other than the impact of ‘Trump’s Trade War’ on the economy. In the meantime, the injection of liquidity continues to support asset prices as the litany of ‘algo’s’ which drive -80% of the trading on Wall Street, respond to more liquidity.”

That is where we are today.

The questions now are:

-

How do you play it; and,

-

What happens next?

How To Play It

As we have been noting over the last month, with the Fed’s more accommodative positioning, we continue to maintain a long-equity bias in our portfolios currently. We have reduced our hedges, along with some of our more defensive positioning. We are also adding opportunistically, to our equity allocations, even as we carry a slightly higher than normal level of cash along with our fixed income positioning.

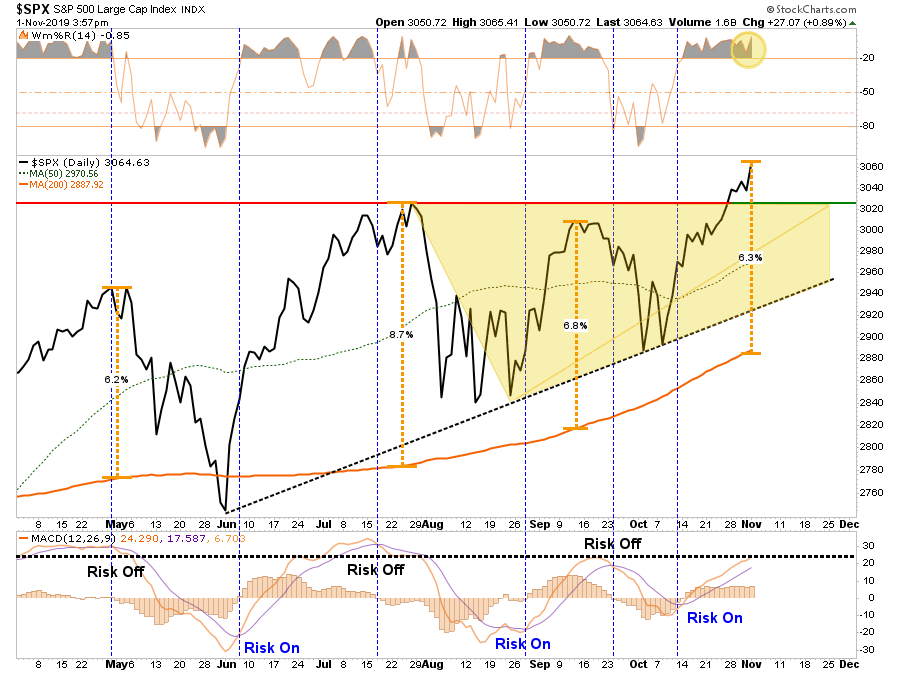

Currently, it will likely pay to remain patient as we head into the end of the year. With a big chunk of earnings season now behind us, and economic data looking weak heading into Q4, the market has gotten a bit ahead of itself over the last two weeks.

On a short-term basis, the market is now more than 6% above its 200-dma. These more extreme price extensions tend to denote short-term tops to the market, and waiting for a pull-back to add exposures has been prudent.

Also, the majority of our indicators are back to more extreme overbought readings, which have typically denoted short-term tops at a minimum.

As I noted last week:

“Given the markets tend to pullback just before Thanksgiving, and during the second week of December, we will have a better opportunity increase allocations if we are patient.“

Once we see that pullback, or even a slight consolidation of the recent advance, we can increase allocations in portfolios towards more equity related exposure.

This begs the question of “what to buy,” which brings us back to our recent RIAPRO.NET article:

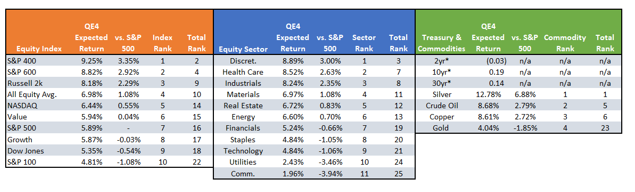

“If we assume that assets will perform similarly under QE 4, we can easily forecast returns using the normalized data from above. The following three tables show these forecasts. Below the tables are rankings by asset class as well as in aggregate. For purposes of this exercise, we assume, based on the Fed’s guidance, that they will purchase $60 billion a month for six months ($360 billion) of U.S. Treasury Bills.

The expected top five performers during QE4 on a normalized basis from highest to lowest are: Silver, S&P 400, Discretionary stocks, S&P 600, and Crude Oil.

I would highly suggest reading the whole article.

What Happens Next?

Michael Lebowitz, CFA recently penned:

“A Honus Wagner baseball card from 1909 was recently auctioned for over $3 million. While that may seem like a lot of money, it is not necessarily expensive. A baseball card is nothing more than paper and ink with no real value. Its street value, or price, is based on the whims of collectors. “Whim” is impossible to value.

Stocks are not baseball cards. Stocks represent ownership in a corporation, and therefore, their share prices are based on a future series of expected earnings and cash flows. Further, there are many other types of investments that serve not only as alternatives, but provide a means to assess relative value.

Today, investors are trading stocks on a “whim,” with scant attention to their value. Unlike a baseball card, when a stock’s street value rises much more than its real value, an inevitable correction will occur. The only question is not if but when will investors realize what they are truly buying.”

There is an important distinction to be made here between “investing” vs. “speculating.”

Benjamin Graham, in his seminal work Security Analysis (1934) defined investing as:

“An operation in which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.”

The problem is that today, the term “investor” is now being applied ubiquitously to anyone who participates in the stock market. As Graham noted later in “The Intelligent Investor:”

“The newspaper employed the word ‘investor’ in these instances because, in the easy language of Wall Street, everyone who buys or sells a security has become an investor, regardless of what he buys, or for what purpose, or at what price, or whether for cash or on margin.”

To understand “what happens next,” one must understand the difference between “investment” and “speculation.”

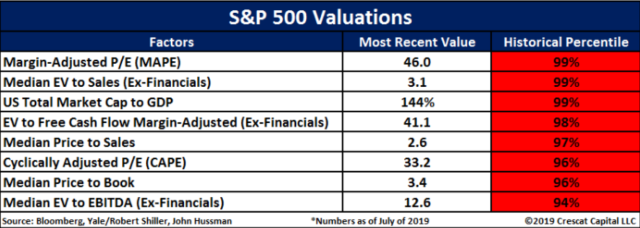

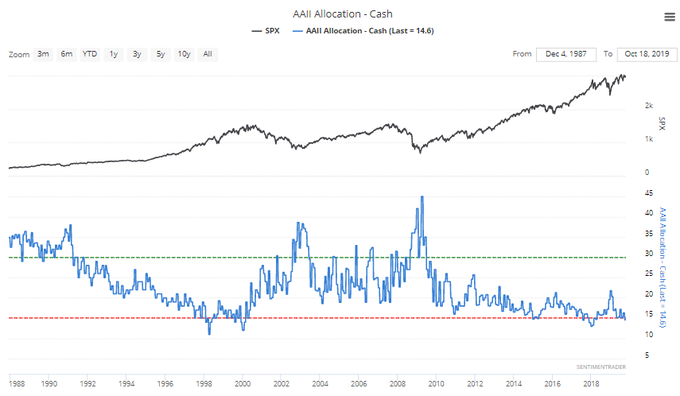

While QE-4 may be driving stocks higher today based on a “whim,” there are two very important difference between QE-4 and QE-1 or 2; 1) stocks are no longer undervalued or 2) under-owned.

“With cash levels at the lowest level since 1997, and equity allocations near the highest levels since 1999 and 2007, it suggests investors are now functionally ‘all in.’”

With investors paying exceptionally high prices for equity ownership, expected forward returns becomes much more problematic. As we addressed on Thursday:

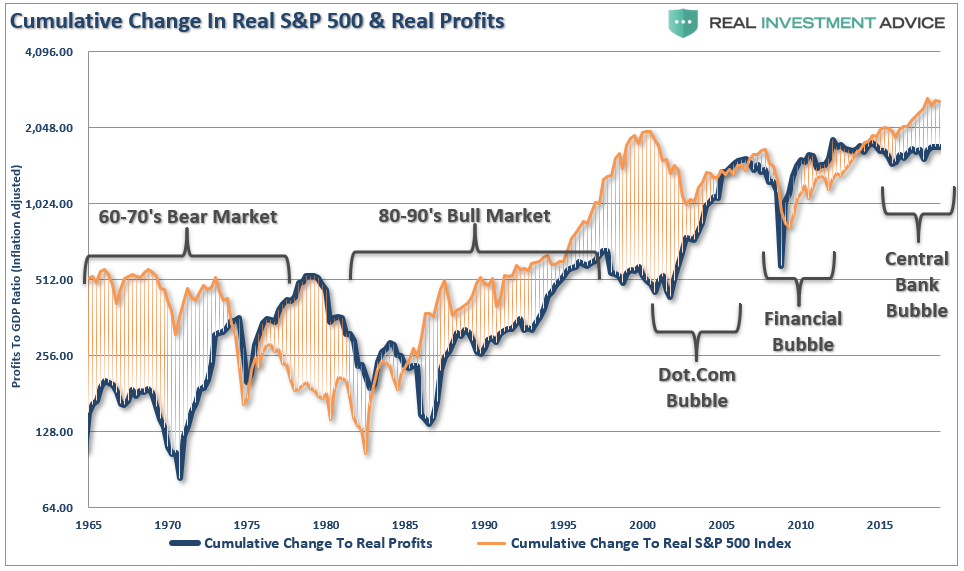

“The detachment of the stock market from underlying profitability guarantees poor future outcomes for investors. But, as has always been the case, the markets can certainly seem to ‘remain irrational longer than logic would predict,’ but it never lasts indefinitely.

‘Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system, and it is not functioning properly.’” – Jeremy Grantham

Another way to look at the issue of profits as it relates to the market is shown below. When we measure the cumulative change in the S&P 500 index as compared to the level of profits, we find again that when investors pay more than $1 for a $1 worth of profits there is an eventual mean reversion.

With investors paying more today than at any point in history for each $1 of profit, the next mean reversion will be a humbling event.

That is just math.

However, in the meantime, individuals are “speculating” within the markets based solely on the premise that a “greater fool” will be there when the time comes to sell.

Unfortunately, that is rarely the case.

There are virtually no measures of valuation which suggest making investments today, and holding them for the next 20-30 years, will work to any great degree.

This is the difference between “investing” and “speculation.”

When you think about QE-4, as it relates to your portfolio, you have to consider the premise of valuations, margin of safety, and risk. Yes, the markets are indeed bullish by all measures, and holding risk will likely pay off in the short-term. (speculation) However, over the long-term, the “house will always win.” (investing)