While the Reddit Raiders have made headlines this past six to nine months by destroying hedge fund short-sellers, crushing options traders, and blowing the minds of fundamental-based analysts; there is another group of investors that has suffered quietly behind the scenes.

Distressed credit investors have long had to have thick skins – taking criticism as predators, even as they sometimes rescue firms no one else will touch and generate returns for pensions, endowments and foundations.

Opportunities to buy on the cheap were rapidly evinced by The Fed last March when it took the unprecedented step of entering the corporate bond market…

Source: Bloomberg

Fiscal and monetary stimulus have greased markets so thoroughly that many of the riskiest companies are now breezing through debt walls with cheap new financing, rather than running into the kind of dead-ends and defaults that generate restructurings or profitable loan-to-own plays.

But, as Bloomberg reports, life in the business is getting even harder, as they can no longer count on a predictable stock market to hedge massive, multipronged bets.

Thanks to the surge in retail dip-buying ‘expertise’ spurred on by Redditors, some distressed funds are being forced to rethink their entire business models.

“It’s become a much harder calculus to even consider,” said Scott Hartman, the global co-head of corporate credit and trading at $14 billion investment firm Varde Partners.

“Frankly, many funds have decided to stay away from shorting these stocks altogether.”

Simply out, retail traders are increasingly propping up troubled firms, further limiting the universe of investment opportunities, where corporate failure is a key part of the investment thesis.

“It’s eerily quiet out there,” said Colin Adams, a senior managing director at corporate advisory firm M3 Partners, where he focuses on debt restructuring.

“You have the twin monsters of fiscal stimulus and low interest rates, and this phenomenon with meme stocks adds a whole new dynamic.”

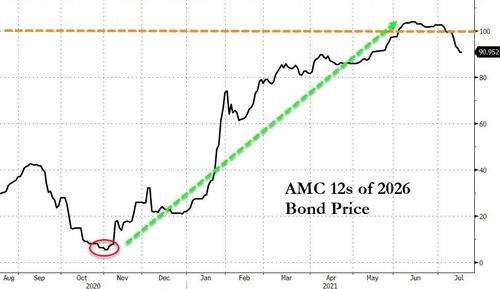

Look no further than AMC. On the verge of bankruptcy in November of 2020, with its 2026 bonds trading at 5c on the dollar; thanks to the buying-panic of the Redditors (and the subsequent equity raises), those bonds are now trading at Par!

Source: Bloomberg

Companies that in the ‘old normal’ would have careened into bankruptcy are no long reliable targets for funds using short stock/option trades to enhance their credit plays.

In the last few months, a trio of mall owners that filed for bankruptcy – CBL & Associates, Pennsylvania Real Estate Investment Trust, and Washington Prime Group – saw their stock prices fluctuate — often surging on little underlying news — as they approached and then entered Chapter 11, where shareholder value gets wiped out almost as a rule.

Brian Sheehy, the founder of IsZo Capital Management, which takes long and short positions across firms’ capital structures, started shorting the mall owners as they began to buckle under the weight of unpaid rent and monthslong store closures.

“I predicted they would go bankrupt, and I was right — but I still lost money,” Sheehy said.

“This stuff now will go straight up into your face until the day they file,” he said, adding that “the incentives are all thrown off.”

As for the few companies that do default or enter bankruptcy these days, retail traders are disrupting outcomes for credit funds there, too.

“The volatility makes it harder for the parties to coalesce around a restructuring plan,” said Dominique Mielle, a former partner at Canyon Capital Advisors and the author of an upcoming book on distressed debt.

“One day the equity of the company has no value and the next it does — that upends the previous day’s work.”

“As investors, we can’t just say these are punks and they’re bidding up a stock for no reason,” Mielle said.

“That may be so individually, but collectively they’re a market power and you’ve got to take that into account.”

How much longer can this farce continue? Ask Jay Powell.