Authored by Jack Ridge via BondVigilantes.com,

This time of year is for thinking about the ones we love. For those of us who spend their working week in the corner of the 7th floor at 10FA, that ‘one’ is bond markets.

When I was thinking about what I wanted to say in this blog, I was going to write about ‘what to love about bond markets now’.

But of course, you don’t love only someone or something for what they offer right now, you love them throughout the economic cycle.

So what are some of the reasons that we have a lifelong love for fixed income?

1. It’s not all about looks, it’s what’s inside that counts

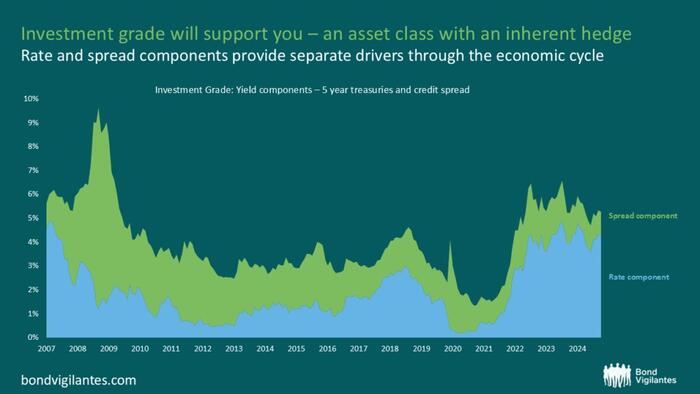

In fixed income, what is on the outside (all-in yields) is important. However, what is under the surface (a combination of the risk-free rate and credit spreads) is even more important, and is the key to a long and happy relationship with the asset class.

An attractive feature of investment grade is the natural in-built hedge. Generally, you will find that when the economy is doing well, credit spreads will tighten as the perceived risk around corporates decreases. The strength of the economy sees greater growth and an uptick in inflation. Consequently, central banks start to raise rates. On the flip side, if the economy weakens, market participants will start to demand a greater risk premium on corporate bonds. In response to this, there is an offsetting effect where the risk-free rate decreases as central banks start to cut rates to support the economy.

In the chart below, we can see that we lost this diversification during COVID as the risk-free rate got down to the zero-bound to prop-up the global economy. However, that diversification is very much back.

That support that you get as a bond investor is certainly something to love!

Source: Bloomberg (31 January 2025). Information is subject to change and is not a guarantee of future results.

2. Bond markets will tell you if they have a problem with you, and not bottle things up

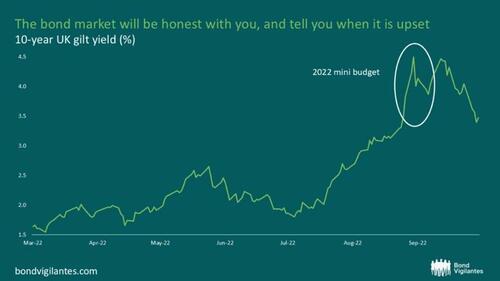

A strong and successful relationship, romantic or otherwise, is built on honesty and trust. There have been many examples over the years of bond vigilante events where the bond market has shown its disagreement with fiscal policy decisions. In the words of Alan Greenspan, ‘the bond market is the ultimate arbiter of fiscal policy.’

The power of the bond market has been shown many times over the years, with the most recent major event being the 2022 ‘mini budget’ in the UK. As we can see in the chart below, 10-year UK gilt yields moved approximately 150bps in the space of less than 10 days. This aggressive repricing was not without consequence. These significant increases in government borrowing costs ultimately led to the resignation of Prime Minister Liz Truss not long later.

Bond markets will certainly not shy away from the tough conversations. With debt-to-GDP ratios in developed markets at all time highs and seemingly only going in one direction, will investors seek to pivot towards countries with lower, more palatable levels of debt (as discussed by Rob Burrows)? Will we see the long end of the curve in indebted developed markets go higher?

Source: Bloomberg (30 September 2022)

3. Bond markets allow you to be you!

In both your view of the market and in portfolio construction, there are many ways to interpret the same data or express a view in a portfolio within the world of fixed income.

From a portfolio construction perspective, access to physical bonds and synthetic alternatives (such as CDS) provide avenues for active managers to exploit relative value opportunities in a variety of ways. The price disparity that is sometimes found between the physical and synthetic market is an example of the perfect imperfections in bond markets, which make this asset class so interesting. Moreover, the ability to unstitch the rate component from the credit component means that fund managers are able to place a view using derivative overlays that may not be possible from a combination of physical holdings alone.

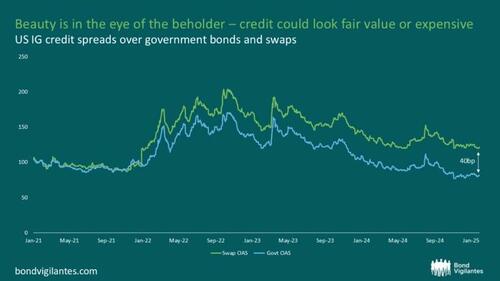

There are various ways to assess value in fixed income. One example is how best to evaluate credit spreads. There are several credit spread metrics which can be used to value corporate bonds, including the additional spread over and above either government bond yields (government OAS), or interest rate swaps (swap OAS).

We will leave the technical deep-dive to another day, but in essence, government bond yields can be influenced by supply and demand dynamics. On the other hand, swap rates are not impacted by the same technical factors. Sometimes spreads over government bonds and spreads over swaps are the same, or very similar. At other times, there is a dislocation. This means that depending on the lens through which you look at credit, corporate bonds could look fair value or expensive. In the below chart, we can see that throughout 2021, both measures in the US market were showing credit spreads to be very similar. However, we are now seeing roughly a 40bp difference.

Which is the correct way to view this? Beauty is in the eye of the beholder!

Source: Bloomberg (31 January 2025)

Bond markets and you – a relationship that lasts a lifetime

We have seen that fixed income has a deep, complex and interesting character, one that continues to foster a strong bond over many years.

Personally, the diversification in investment grade bonds, the honesty of bond vigilantes, the freedom to express one’s views and the different ways to view the same thing have got me hooked!

Loading…