Today’s insanity was brought to you by the words “delay” and “protests” and by the number “0” as Trump blinked and ‘delayed’ some China tariffs, Hong Kong ‘protests’ in the airport escalated, and all eyes were on the UST curve’s 2s10s spread rapidly plunging toward ‘0’…

Chinese stocks leaked lower on the day but held gains on the week…

Source: Bloomberg

European stocks surged on the trade headlines but Spain remains red on the week…

Source: Bloomberg

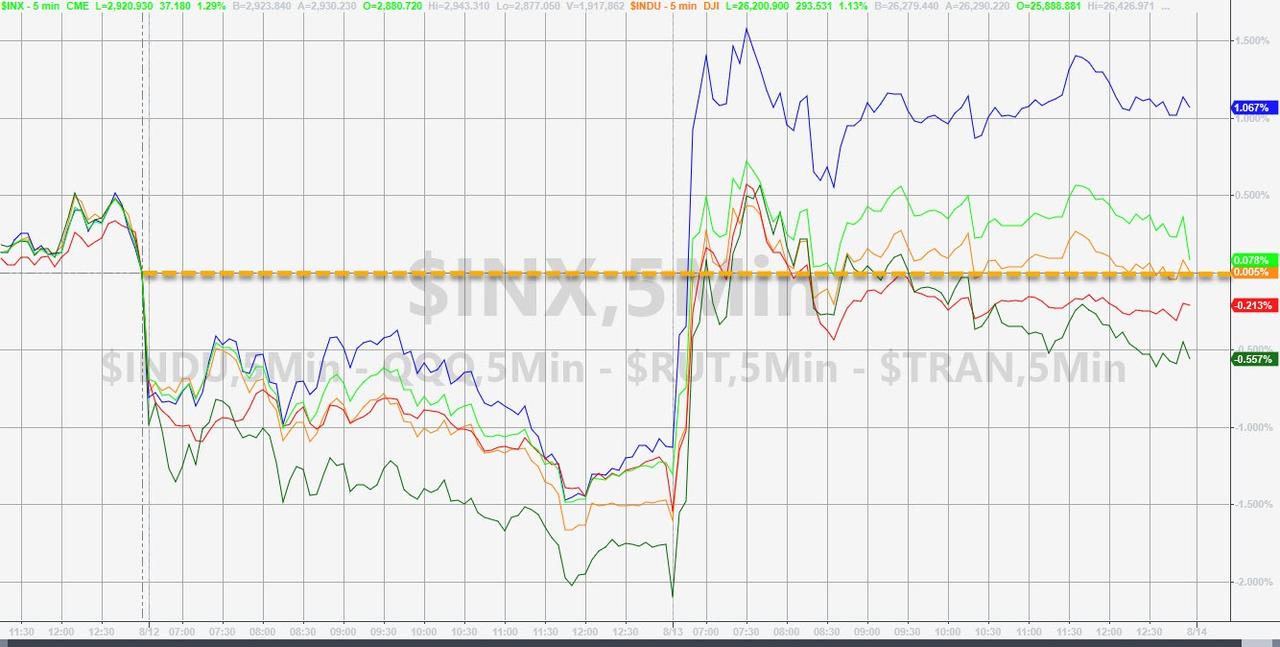

A big day for US equities thanks to trade headlines rescuing another ugly overnight session…

However, The Dow, Small Caps, and Trannies were unable to erase yesterday’s losses (weak close)…

But we note that, stocks were unable to break key resistance levels (Dow futs stalled at the Fib 61.8% retracement level of the July/Aug plunge)

Close-Up…

And all the majors stalled at or below key technical levels…

AAPL was a big driver of markets today, but look where it stalled…

Cyclicals outperformed, as you’d expect, today; but since Friday, Defensives are leading…

Source: Bloomberg

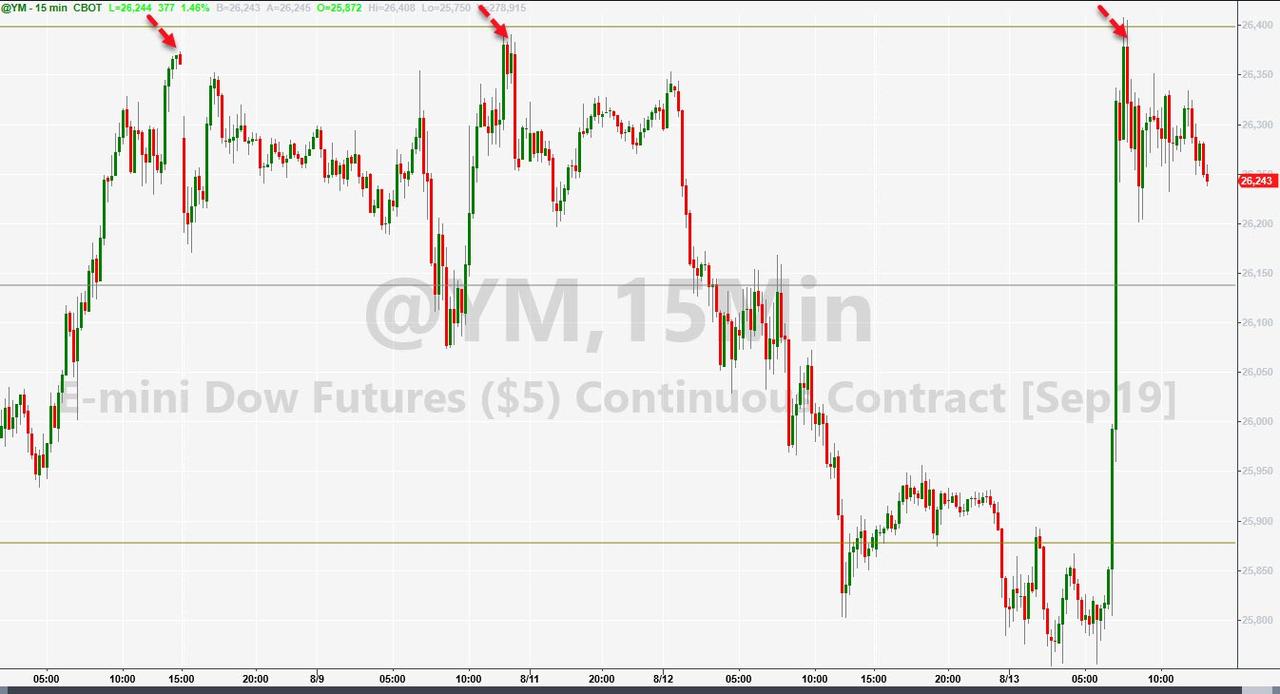

Stocks, as always, more excited than bonds about everything…

Source: Bloomberg

As StanChart’s Steve Englander noted: “The key characteristic of recent episodes of risk-off and risk-rebound is that the equity-market consequences are largely reversed, while the downward moves in fixed income have largely stayed in place.”

Treasury yields were all notably higher on the day, spiking after the trade headlines (but the long-end dramatically outperformed the short-end) – also note that all yields slipped lower in the last hour (only 2Y is higher in yield on the week)…

Source: Bloomberg

But the yield curve refused to stop flattening, with 2s10s falling below 1bps for the first time since May 2007…

Source: Bloomberg

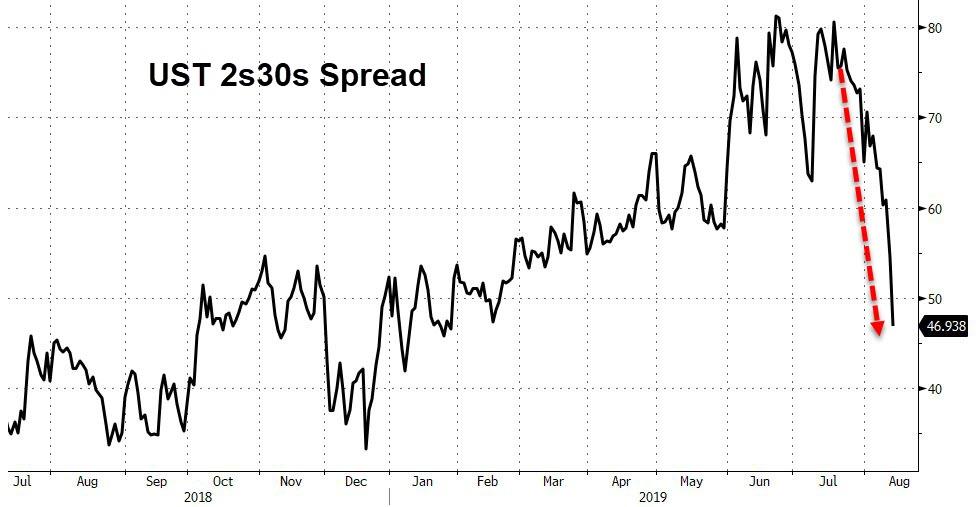

And 2s30s crashed to its lowest levels of 2019…

Source: Bloomberg

The Dollar managed gains on the day but remains within a very narrow range since The Fed cut rates…

Source: Bloomberg

The Yuan exploded higher on the trade headlines, surging below 7.0/USD before fading back to the CNY Fix…

Source: Bloomberg

The Hong Kong Dollar was relatively volatile intraday but remains a few pips away from the 7.85 weak-end of the USD peg band…

Source: Bloomberg

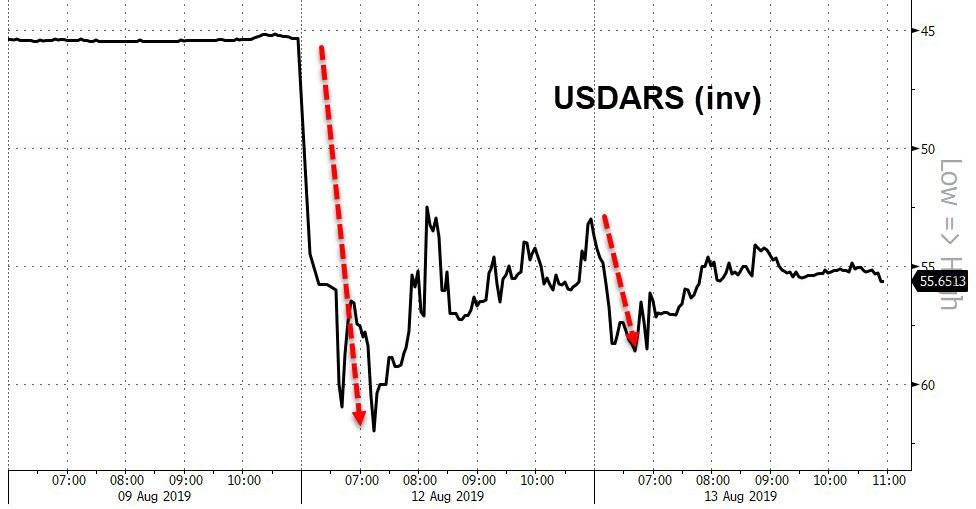

The Argentine Peso did not stop its freefall…

Source: Bloomberg

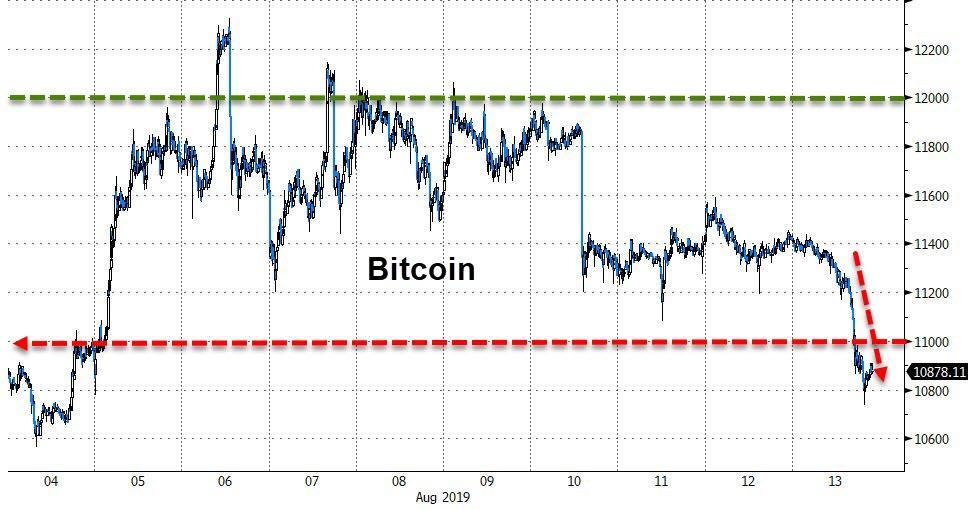

In cryptos, Bitcoin tumbled on the day as Bitcoin Cash soared…

Source: Bloomberg

Bitcoin fell back below $11,000…

Source: Bloomberg

Oil spiked on the trade headlines (as did copper) and PMs (safe havens) tumbled…

Source: Bloomberg

Gold futures tumbled buyt bounced off $1500…

WTI Crude ramped up to $57 handle ahead of tonight’s API inventory data…

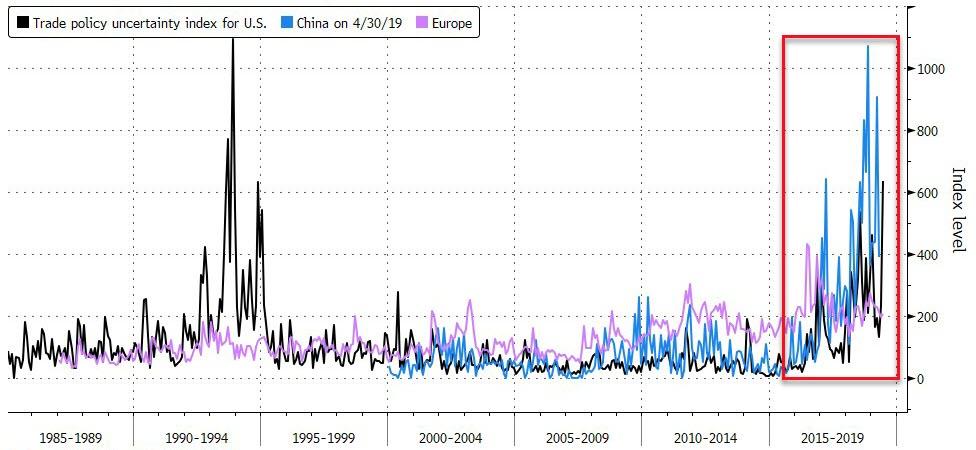

Finally, some context for the headlines today, the market-implied odds of a trade deal initially spiked but faded back as the day wore on…

And Bloomberg’s Tom Orlik explains why: Tariffs are not the only, or perhaps even the main drag from the U.S.-China trade war. That prize goes to head-spinning policy uncertainty.

A gauge of trade policy uncertainty in the U.S. is at levels not seen since Nafta ratification in the 1990s. China and Europe face a similar problem.