![]() The fiscal effects of the One Big Beautiful Bill Act are under scrutiny as lawmakers attempt to get the tax-and-spending package on President Donald Trump’s desk for his signature before July 4.

The fiscal effects of the One Big Beautiful Bill Act are under scrutiny as lawmakers attempt to get the tax-and-spending package on President Donald Trump’s desk for his signature before July 4.

Critics have said the House Republicans’ legislation would worsen the federal government’s fiscal health.

The White House has rebutted these claims, noting that the reconciliation package is not a budget bill or a blueprint for balancing the budget.

Instead, it is a procedural tool designed to advance as much of the president’s agenda through Congress as possible, based on the Republican votes currently available, and it excludes projected revenue from tariffs and economic growth tied to tax cuts, according to Trump’s top budget official Russ Vought.

Still, various organizations estimate that this legislation will exacerbate federal deficits and contribute to the national debt over the next decade—a key point of contention between billionaire Elon Musk and Trump in recent days.

Here is a look at the different projections through the 2025–2034 budget window.

Clashing Estimates: CBO versus White House

The Congressional Budget Office (CBO), a nonpartisan budget watchdog, released its scoring on the House-approved package.

“This lie is based on a CBO accounting gimmick,” he said.

“Income tax rates from the 2017 tax cut are set to expire in September. They were always planned to be permanent. CBO says maintaining ‘current’ rates adds to the deficit, but by definition, leaving these income tax rates unchanged cannot add one penny to the deficit.”

Vought also rebuked the CBO’s scoring methodology.

“CBO continues to use a baseline that is fundamentally skewed toward the way the real world is,” Vought said in a press call.

“The basics of that is that they assume that all spending will continue into eternity, your appropriations bills, all of your mandatory spending that gets a free ride into eternity, but somehow tax relief that has an expiration date isn’t assumed for the entirety of the fiscal window.”

Speaking to reporters at the White House during the president’s meeting with German Chancellor Friedrich Merz, Treasury Secretary Scott Bessent also alluded to the CBO’s recent tariff projections.

This week, the CBO projected that tariff revenues will slash deficits by $2.8 trillion over 10 years, which Bessent said “puts the bill in surplus if you include the tariff revenue, which they won’t do.”

What Do Other Forecasters Say?

Meanwhile, other independent organizations have presented similar debt and deficit projections for the bill.

“Overall, the bill would prevent tax increases on 62 percent of taxpayers that would occur if the TCJA expired as scheduled,” Tax Foundation economists said.

According to Yale’s Budget Lab, over a 30-year window, the bill would add $10.8 trillion to the national debt.

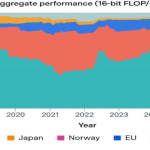

“If the tax provisions become permanent, with no additional tariff revenue, the debt-to-GDP ratio would hit approximately 191 percent in 2055. The only countries that currently have a higher debt-to-GDP ratio are Japan and Sudan,” the Budget Lab said in its May 30 update.

Bill Would Boost Economic Activity: White House

Once the bill is enacted, the White House states that the administration’s actions, whether increased tariff revenues or substantial spending cuts, will reduce deficits by “at least $6.6 trillion over the next decade.”

Supporters argue that the tax-and-spending plan, which includes tax cuts, would increase government revenues through more vigorous economic activity. This concept is related to the famous Laffer Curve, developed by the eminent economist Art Laffer.

According to the Laffer Curve, popularized in the 1970s, there is an optimal tax rate that maximizes revenue, highlighting the relationship between tax rates and tax receipts.

Following the passage of the 2017 Tax Cuts and Jobs Act, actual revenue from 2018 to 2024 totaled approximately $28.5 trillion. This has been $1.5 trillion higher than CBO’s projections—before adjusting for inflation.

Interest Cost on New Debt

In a separate CBO report, released on June 5, officials predict that the One Big Beautiful Bill Act would trigger additional debt-servicing costs of $551 billion over the 10-year period.

“That change would increase the cumulative effect on the deficit to $3 trillion,” the report stated.

Experts from the Committee for a Responsible Federal Budget, an independent policy organization, estimate that interest costs on the new debt from the bill will amount to $1.8 trillion, accounting for 4.2 percent of GDP.

If interest rates remain elevated—the benchmark 10-year Treasury yield hovers around 4.5 percent—interest payments could surge to $2.1 trillion in 2034, representing more than 5 percent of GDP.

“All else being equal, higher debt and deficit levels will raise interest rates,” the Yale Budget Lab said.

Fiscal health concerns have taken center stage in the U.S. Treasury market.

While rates have stabilized, the 30-year Treasury yield recently topped 5.1 percent, the highest level since October 2023.

This is a vital development since it influences consumer and business borrowing costs and how much it costs the federal government to service the debt.

Over the past few years, federal interest payments have increased significantly amid tighter Federal Reserve monetary policy and rising government spending. They are now the second-largest budgetary item, second only to Social Security.

Annual federal interest payments are expected to exceed $1.2 trillion this fiscal year, according to the Treasury Department.

Rocket Fuel or Lackluster Growth?

Many estimates suggest that the bill would provide a boost to the U.S. economy.

Penn Wharton projects that its economic effects would increase GDP by 0.4 percent in 10 years and 0.7 percent in 30 years. The Tax Foundation expects long-run GDP to grow by 0.8 percent.

On the labor front, according to the Tax Foundation, “hours worked converted to full-time equivalent jobs” would be 983,000. Additionally, pre-tax wages would grow by less than 0.05 percent.

Average wages are projected to decline by 0.2 percent over the next 10 years but increase by 0.3 percent thereafter.

The committee says up to 7.4 million full-time jobs will be saved or created, and workers could receive up to $11,600 in higher wages.