Authored by Michael Msika, Bloomberg,

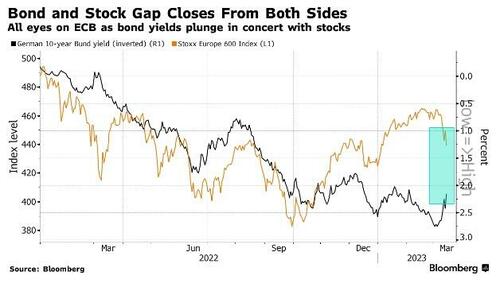

The turmoil around Credit Suisse is gripping traders’ attention just days after the collapse of Silicon Valley Bank. For investors holding bank shares, today’s European Central Bank meeting will be a test case for whether monetary authorities hold the line with interest rate hikes, even in the face of financial sector stress.

The Credit Suisse crisis and Wednesday’s rout across European bank shares mean the ECB can’t dismiss the downfall of SVB and two other US lenders as a transatlantic problem. The Swiss lender’s problems are long standing, but there is no denying that bond market volatility, relentless rate rises and the threat of economic recession can lead to severe financial sector stress.

Authorities will have watched with alarm as the Stoxx 600 Banks Index, Europe’s best-performing sector at the start of March, erased most of its year-to-date gains in the space of a few days.

Credit Default Swaps, a barometer of risk, are on the rise.

The question for the ECB is whether the shakeout is merely that — a shakeout — or a sign of real trouble.

BNP Paribas strategist Ankit Gheedia describes the selloff as a sort of “capitulation moment” for European banks, exacerbated by crowded long positions in the sector.

“It’s too early to say if the bull case for banks is behind us or not, but clearly price action is concerning, and seeming like it would need some external support from regulators,” Gheedia adds.

Positioning was indeed very extended. JPMorgan European derivatives strategist Davide Silvestrini points out that net long positions in Euro Stoxx banks’ futures surpassed €3 billion ($3.2 billion) before this week’s selloff, near the highest since the Ukraine war erupted a year ago. Bullish option trades had also accumulated, hence the “overreaction,” Silvestrini says.

Many reckon that with euro area inflation running at 8.5%, the ECB will look through the turmoil and deliver a 50 basis-point rate hike.

After all, its chief Christine Lagarde recently described inflation as a “monster” that must be slain, a view reinforced by this week’s above-forecast US price data.

The US print showed further rate hikes are needed, but this risks more financial stability stress, says Evgenia Molotova, senior investment manager at Pictet Asset Management.

“Hence we might end up with either recession, if the rate hikes continue, or entrenched inflation if they don’t. It is very relevant for Europe as well as US.”

One crucial point though, is that the surge in credit default swaps on Credit Suisse has not triggered panic about other large banks, though their CDS too have risen. European bank shares trade at cheap valuations and are seen as more tightly regulated than US peers. The heightened scrutiny of banks for balance-sheet mismatches is also a positive, investors say.

“We remain bullish on European banks, the investment case on fast growing net interest margins is still intact,” said Fabio Caldato, a partner at Olympia Wealth Management, who is keen to invest in the sector.

“Regulations matter and European rules are luckily conservative.”

However, recession worries are already driving investors out of growth-sensitive cyclical shares such as autos, banks and retailers, a possibility this column had flagged at the end of February. Instead, defensive sectors such as food and pharma are back in favor.

John Leiper, CIO at Titan Asset Management, is among those taking a defensive stance. “We are now starting to see the impact of prior tightening starting to bite,” Leiper says. “We remain concerned that these ripple effects will continue to spread across the economy.”

Loading…