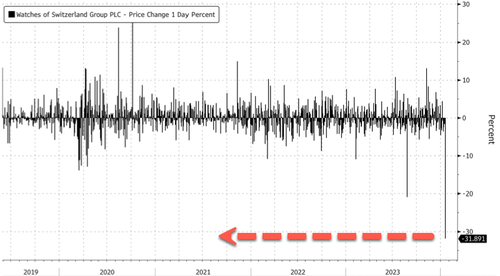

Shares of Watches of Switzerland Group Plc crashed as much as 32% to the lowest level since November 2020 after the luxury retailer slashed guidance for the 2024 fiscal year.

Watches of Switzerland, a seller of Audemars, Cartier, Rolex, and Piguet, blamed a downturn in luxury spending for its misfortunes:

“Despite a positive start to the early part of Q3 FY24, WOSG then experienced a volatile trading performance in the run-up to and beyond Christmas, as the challenging macro-economic conditions impacted consumer spending in the luxury retail sector,” the company said in an update.

“We now expect these challenging conditions to remain for the balance of our fiscal year.”

That said, the company cut its full-year revenue target to between £1.53-1.55 billion ($1.94-1.97 billion) from the previous guidance of £1.65-1.7 billion. Revenue growth was revised sharply lower from 8 to 11% to 2 to 3%,

Shares trading in London plunged as much as 32%.

Shares are back to levels not seen since early Covid.

“The festive period was particularly volatile this year for the luxury sector, with consumers allocating spend to other categories such as fashion, beauty, hospitality and travel. Whilst we are disappointed with this trend, we are encouraged by our market share gains in both the US and the UK,” Chief Executive Officer Brian Duffy wrote in a statement.

“The extent of the adjustments to the guidance range will be painful to navigate in the near term,” analysts at Jefferies wrote in a note.

Analysts at Peel Hunt said today’s warning was “a blow to sentiment.”

The warning from Watches of Switzerland comes as the luxury downturn persists into the new year.

Loading…