Authored by Simon White, Bloomberg macro strategist,

Bonds’ diminishing ability to act as a hedge for stocks jeopardizes the concept of the standard 60% equities, 40% bonds approach to portfolio design.

A lack of viable alternatives for bonds may lead to increased stock exposure, threatening long-term financial and economic stability.

TINA is coming back, but this time with a vengeance. In the salad days of zero rates and fast-expanding central bank balance sheets, stocks were the only game in town. Nothing – not bonds, commodities or real estate – offered higher returns. TINA – There Is No Alternative – really was it.

One pandemic, multi-decade-high inflation and over 500 bps of rate rises later, the investing landscape has changed fundamentally. Equities entered a bear market and have yet to re-take their January 2022 highs, but still, owning them might start to look even more unavoidable than before.

The game-changer is inflation. In last week’s column, I explained how elevated inflation has taken the stock-bond correlation positive after being negative for most of the last two decades. Bonds, i.e. USTs, are losing their ability to act as a portfolio and recession hedge. They are therefore prone to structurally higher yields as the negative risk premium they commanded for their hedging abilities is wiped out and significantly reversed.

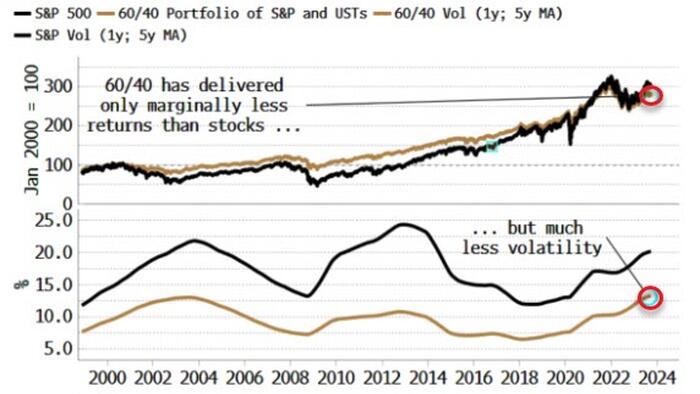

If bonds won’t cut it any more, what then are some of alternatives for the “40” portion of the 60/40 portfolio? The attractiveness 60/40 with USTs was that they significantly reduced portfolio volatility, while only marginally reducing the total return over the past quarter of a century.

Thus any viable alternative to Treasuries ideally has a lower Sharpe ratio. I considered corporate bonds (Baa), TIPS, commodities, gold and cash as the 40% part of a 60/40 portfolio. I built indexes for each from the late 1960s, and looked at their excess returns (i.e. versus compounded three-month T-bill rates), in both real and nominal terms.

Over the whole period (1968-2003) stocks have the highest excess real and nominal return. They returned 8.2% annualized compared with 4.6% for cash, giving an excess nominal return of 3.7%. But inflation was 4% annualized over the period, meaning stocks have posted a negative real excess return over the past 55 years.

Other asset classes and 60/40 constructions I looked at delivered a lower excess return, while commodities posted a negative excess return over the period in question. Beating cash and inflation over the long term is not easy.

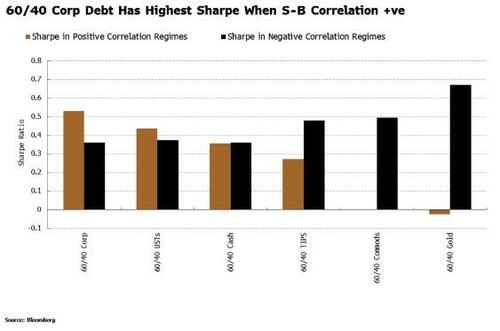

Let’s see how this changes when we condition on whether the stock-bond correlation is positive or negative (using the two-year correlation of one-week changes in the S&P and the Bloomberg Treasury Bond Index, smoothed over two years).

The results are not necessarily what you would expect. For a start, 60/40 with USTs has one of the lowest Sharpes in regimes when the stock-bond correlation was negative, being cleanly beaten by 60/40 with TIPS, commodities and gold.

In positive stock-bond correlation environments it’s even worse, with the Sharpe of 60/40 with USTs dropping to 0.27 from 0.56. Even though the nominal return of 60/40 USTs was higher at 9.7%, cash was also higher – as is typical when stocks and bonds are moving together. That led to a real excess return of only 3.1%, neatly illustrating why the bar for performance is even higher in positive-correlation regimes.

A 60/40 gold and 60/40 commodities strategy delivered the highest real Sharpe ratios when the correlation is negative, perhaps surprisingly given gold and commodities have greater volatility than equities.

High returns in especially the 1970s compounded up over time and outweighed the effect of their elevated volatility.

We are now in a positive-correlation regime, and there are no good options as all strategies, including 60/40 with USTs, have delivered a lower real Sharpe when stocks and bonds are positively correlated.

Naively, looking at the chart above, one would choose 60/40 with corporate bonds as the least worst option. But the Treasury market dwarfs the corporate bond market, and managers with liquidity constraints would be unable to replace the bulk of their USTs with corporates. Ditto with TIPS, gold and commodities, which anyway have lower real Sharpes than USTs. And cash is an unrealistic long-term option for investors who have to justify their fees, as well as entailing high rollover risk.

Bonds will still serve their purpose for liability matchers such as pension funds, but those running 60/40-like strategies (with hundreds of billions if not trillions of dollars under management) will find it increasingly difficult to justify maintaining the same proportion of bonds if they are not serving their central purpose of smoothing portfolio returns.

With no viable alternatives that are liquid enough, or likely to improve risk-adjusted returns, the temptation to add more equity risk and chase returns may become too great. That’s even more the case when we remember that both cash and inflation are higher than average when stocks and bonds track each other, as they do currently, intensifying the need to maximize returns.

There’s a weary familiarity to all of this. Needless to say, such rising concentration risk will increase financial instability and expose markets to significant falls over the longer term. This time, then, TINA’s return may be her swan song.

Loading…