Oil prices edged higher today as traders anxiously await tomorrow’s CPI and FOMC risk catalysts for any signals on the trajectory of oil demand.

“After recent declines, oil prices have room to recover in the short term,” Morgan Stanley analysts including Martijn Rats and Charlotte Firkins said in a note.

“Nevertheless, inventories are currently higher than we expected some time ago, and on current trends, supply/demand balances will likely weaken after the third quarter.”

Energy stocks ended lower on the day while WTI inched up to $78. All eyes on API for cues on whether this rebound in price can be sustained…

API

-

Crude -2.4mm

-

Cushing -1.94mm

-

Gasoline -2.55mm

-

Distillates +972k

Crude and gasoline stocks saw sizable draws last week as did the inventories at the Cushing Hub…

Source: Bloomberg

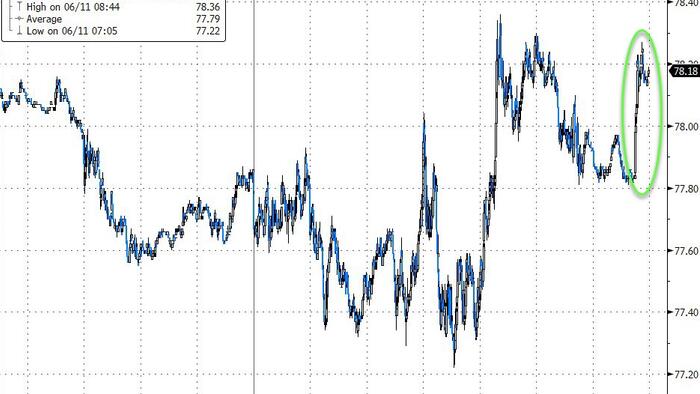

WTI was hovering around $77.80 ahead of the API print and bounced back above $78 on the draw…

Along with OPEC+ plans to phase out voluntary output cuts after September, “we think this signals a cautious optimism from the organization when it comes to the trajectory of future supply/demand,” says Rohan Reddy, director of research at Global X in emailed comments.

“The mid-$70s to low-$90s crude pricing we’ve seen in Brent over the past few quarters seems to be a range that OPEC is comfortable with, as the organization maintains its holding pattern,” he adds.

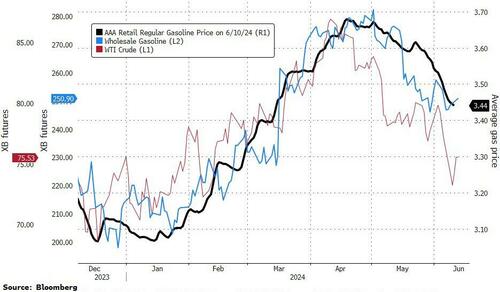

Meanwhile, pump prices have fallen to three month lows as crude and gasoline prices have fallen…

But it’s not helping Biden’s poll numbers…

Loading…