Crude prices soared today, round-tripping yesterday’s losses, after traders apparently woke up to the tensions in the MidEast.

Traders have largely looked past shipping disruptions in the Red Sea and the threat of a wider war in the Middle East over the past few weeks as those factors have yet to impact global oil supply and output, but the Danish shipping giant Maersk said today it would indefinitely suspend shipments through the Red Sea.

But major fatalities following explosions at a ceremony held to mark the four-year death anniversary of an Iranian Maj. Gen. Qassem Soleimani (prompting Iran to explicitly threaten a response) and reports that Libya’s largest oilfield has been shut down due to protests, may have been the straw to break the back of complacency.

Overall, the oil market seems “likely to be in rough balance, but uncertainty about supplies abound – from sanctions on Iran, Russia and Venezuela having less effect, to the possibility that [U.S. President Joe] Biden will try to tighten them,” said Michael Lynch, president of Strategic Energy & Economic Research.

Will tonight’s API data give us any hints

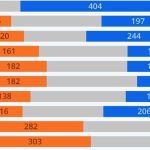

API

Crude stocks saw an unexpectedly large drawdown last week, but very large builds in products spoiled the bulls’ party. Cushing stockpiles rose for the 11th month…

Source: Bloomberg

WTI was hovering at $73 ahead of the API print and maintained it after…

“Nobody wants to be short crude below $70 when there is unrest in the Middle East,” said Dennis Kissler, senior vice president at BOK Financial.

OPEC also on Wednesday released a statement saying it was committed to “unity, full cohesion and market stability.”

Loading…