Authored by Owen Evans via The Epoch Times (emphasis ours),

The West may have found an unexpected way to chip away at communist China’s dominance in the production of critical minerals: extracting metals from oil wells, waste streams, and discarded electronics in an attempt to scale up processing technologies at home.

Instead of waiting years for new mines to open, a wave of startups is turning to existing resources to recover metals that Beijing has controlled for decades.

“Chevron’s wells in just three [Texas] counties can actually produce the world supply of rhodium,” Eric Herrera, CEO of MaverickX, recently told The Epoch Times.

Rhodium is the world’s most valuable precious metal, prized for its ability to neutralize toxic emissions.

It sits alongside a wider class of materials that make up the hidden components in smartphones, electric vehicles, renewable energy, and even weapons.

Geostrategic Weaponized Tools

Rare-earth elements such as neodymium and dysprosium are not actually rare. They are abundant but difficult to separate, while minerals such as lithium, cobalt, and tungsten are deemed “critical” because modern economies and defense systems cannot function without them.

Currently, China controls roughly 90 percent of global capacity for the processing, smelting, and separation of all such materials, as well as for the manufacturing of magnetic materials.

This means that while the United States, Australia, Brazil, India, and parts of Africa are racing to establish new mines, most of their concentrates will still have to travel to Chinese refineries.

Beijing knows the leverage this monopoly provides and used it most recently during a trade spat with the United States by restricting exports of rare earths, germanium, and other critical materials this year.

In 2010, China cut off rare-earth exports to Japan for about two months during a territorial dispute.

Meanwhile, Western companies are seeking to confront China’s processing advantage by leapfrogging it.

Replacing China

Herrera’s company is developing methods to recover more metal from existing ore and waste, juicing rocks and discarded electronics for all they are worth.

He told The Epoch Times that he also believes that part of the solution lies under American oil fields.

He said his process can use oil wells to yield not only rhodium, but also titanium, nickel, vanadium, cobalt, copper, and more.

“The oil here in Texas is 19,000 feet deep, about 110 stages,“ he said. ”Each stage has about 110,000 gallons or 20,000 gallons of water to use that’s already permitted, that’s already set up, and the infrastructure is already deployed.”

“All we have to do is add our chemical to take the metals out, and then separate the chemicals. … That’s much, much faster, much cheaper as well,” he said.

Herrera said the oil industry can also move more quickly than traditional mining operations. For major companies, it takes at least five to 10 years for a new technology to reach a mine site.

It also uses existing infrastructure. Moreover, unlike a mining project, a well can be shut down with minimal disruption, whereas killing a copper mine is far more consequential, he said.

That speed, Herrera said, may allow Western companies to compete with China’s processing advantage in a “slow and steady” way.

“I don’t think it’s going to happen all at once,“ he said. ”I think it’ll be subtle, a couple of wells first, more wells, then fields, then entire plains of oil, all of those will have to be going at full capacity to take it away from China.”

“We’re not at that level yet, I think in a couple of years we can get to that level, and if we all do it at once, then yes, then China would absolutely respond,” he said, noting that the same technology could be deployed in other major countries with metal-rich geology, including Kazakhstan and Saudi Arabia, whose hot shales are known to contain extractable uranium.

Can ‘Prevent Wars’

At Rice University in Houston, chemist and nanotechnologist James Tour has pioneered a method for quickly extracting rare-earth metals.

Tour developed a technique capable of breaking down electronic waste, ash, tailings, and more to rapidly recover rare-earth metals and other critical minerals, with a minimal environmental footprint.

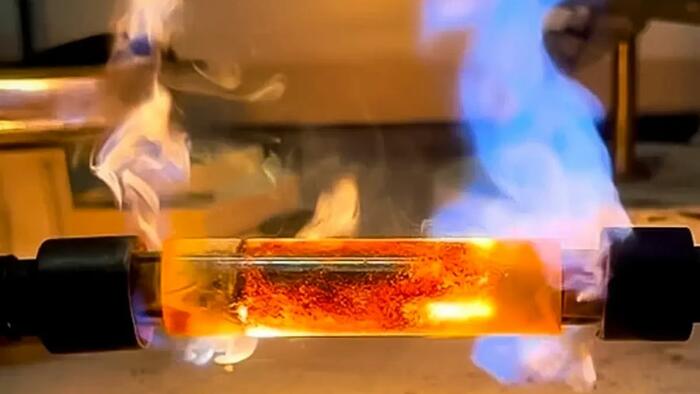

His method uses flash Joule heating technology, a patented process that raises material temperatures to thousands of degrees within milliseconds and uses chlorine gas to extract rare-earth elements from magnet waste in seconds without needing water or acids.

Tour said his flash Joule heating technology is already commercially proven in the company Universal Matter, which was spun out of his lab, and in other contexts with graphene, a one-atom-thick form of carbon used to strengthen materials, improve battery performance, and enhance electronics.

“People never really knew how to scale that, and we came up with a process to do this using flash Joule heating,“ he told The Epoch Times. ”That company is up and running and making 1 ton per day of graphene, and it’s already introduced into concrete and asphalt markets.”

The rare-earth version is close behind with a Texas factory that has licensed the method for metal recovery.

He said Flash Metals USA, the U.S.-based subsidiary of Australia’s Metallium, is aiming to process 1 ton per day of print circuit boards by January 2026 and 20 tons per day by September 2026 to recover the rare-earth elements and critical metals they contain.

Electronic waste can contain metal concentrations up to 1,000 times higher than those found in natural ores.

“It’s easier to just deal with things that we already have separated, that we have already deployed into our current electronics and magnets that we’re throwing away,“ Tour said. ”This is [a] treasure, it’s an absolute gold mine.”

The technologies behind modern rare-earth separation were developed in the United States during the Manhattan Project led by J. Robert Oppenheimer. Solvent extraction methods were later adopted to isolate individual rare-earth elements.

The United States dominated global production through the 1960s and 1970s via California’s Mountain Pass Mine but lost that position after the mid-1980s as China, initially lacking expertise in heavy rare-earth refining, expanded mining and processing.

A key turning point occurred in 1995 when General Motors sold its magnet subsidiary Magnequench, the last U.S. company making rare-earth magnets, to a Chinese-led consortium. The sale was approved by the Committee on Foreign Investment in the United States and resulted in the transfer of technologies and operations to China, marking the end of U.S. leadership in rare-earth production.

The deal was condemned in 2005 by Sen. Jim Inhofe (R-Okla.) for leaving the United States without a domestic neodymium magnet supplier during Washington’s broader economic opening to Beijing under President Bill Clinton.

Tour said China’s monopoly has also bred its environmentally destructive refining methods.

“This is a horrendously messy process in China, and they’ve contaminated the cities and the rivers in those cities and the water systems in those cities,” he said.

Tour said the Trump administration is treating the issue of rare-earth processing with great importance.

“President [Donald] Trump’s very serious, and it’s this type of thing that can prevent wars,” he said.

“[But] if we don’t have access to these elements, we will go to war. This is the stuff you fight over.”

With guaranteed pricing, Tour said, the U.S. government will counter China’s tactic of artificially depressing prices and bankrupting competitors by flooding markets with cheap material to render Western projects uneconomic.

“The U.S. government will stand behind us, make sure that we get paid a fair price for this, so that the Chinese cannot just artificially drop the price and put us out,” he said.

A former U.S. Army officer said she views the rare-earths issue as “the free world against the not-free world.”

Jessica Lewis McFate, who is now senior director of intelligence solutions at Babel Street, focusing on open-source intelligence and national security, said the implications around sourcing rare earths are profound.

McFate told The Epoch Times that if a Fortune 500 company were to lose access to rare earth-dependent components such as gallium for six months, the impact would extend well beyond a shortage of high-performance chips used in high-intensity computing or radio-frequency applications, including weapons and radar systems.

Gallium, she said, is also critical in medical technologies, meaning that disruptions would ripple across both national security and civilian sectors.

“It scales out to our smartphones, it scales out to MRI machines,” she said.

“And it becomes this requirement for CEOs to all of a sudden really ask how much they know, and ask their vendors tough questions [such as] ‘Where did you get the circuit board?’”

“The Chinese perspective is that they are fighting a war,” she said.

“I think it’s a lot safer for humanity if we fight back by non-lethal means for what we believe in. So I think it’s OK to be deeply competitive and even clever in our competition for advantage.”

‘Momentum Is Clearly Shifting’

Billions of dollars in federal funding are now moving into the sector.

The Department of Energy has announced nearly $1 billion in funding opportunities aimed at supply chains for critical minerals and rare earths, covering mining, processing, manufacturing, recycling, and byproduct recovery.

Under the Trump administration, Washington now holds stakes in MP Materials, Vulcan Elements, ReElement Technologies, and Lithium Americas, and has struck critical minerals deals with more than a dozen countries.

Australia is becoming the strongest non-Chinese processing hub through Lynas’s expansion, Iluka’s Eneabba refinery, and Arafura’s Nolans Project.

Read the rest here…

Loading recommendations…