The precious metals complex resumed its upward trajectory overnight. Shortly after the US equity cash open, silver surged above $100 per ounce for the first time on record, while gold approached the $5,000 per ounce level.

As Rick Privorotsky, head of Delta One at Goldman Sachs, noted to clients earlier, flows suggest some speculative participation, but the dominant driver remains structural: “There is clearly hot money involved, but first and foremost gold is a central bank trade… a slow erosion of the dollar’s exorbitant privilege rather than a sudden loss of confidence…”

What first came to mind as silver broke above the $100 level was Warren Buffett’s late-1990s bet on the precious metal. Berkshire Hathaway accumulated 129.7 million ounces of physical silver, or about 4,000 metric tons, ahead of the Dot Com bubble crash. The position was disposed of around 2006, generating a substantial profit for Berkshire.

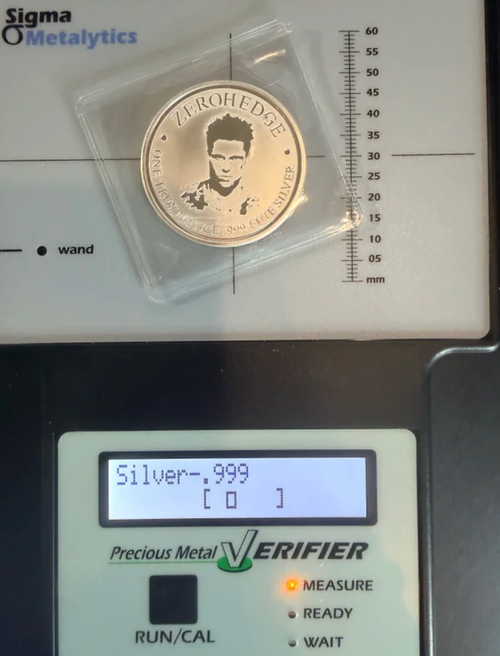

Fast forward to October 2024, and we rolled out the zh silver/gold coins and bars. At the time, silver was in the low $30s, while gold hovered around $2,600.

But on an even grander scale, several months later in early 2025, David Bateman, the founder of Entrata, revealed on X that he had purchased “close to a billion dollars in precious metals over the past six months.”

To be exact, Bateman told his followers on X that he bought “1.5% of the annual global silver supply (12.69 million ounces).”

His reasons for the massive physical trade were as follows:

-

The global monetary system is about to collapse (The Great Reset, or Basel Endgame).

-

The biggest credit bubble in history will soon pop ($300T).

-

There is no way the US can refinance its $28T in maturing treasuries in the next 4 years without an obscene amount of printing.

-

Trump tariffs are hastening the collapse, and it’s by design.

-

Gold and silver are the only meaningful life raft. Physical possession is everything.

-

The whole world right now is a sophisticated game of musical chairs; the chairs are precious metals.

-

Crypto is a psyop. Those who purchase will have no chair when the music stops.

-

Real estate, crypto, stocks and bonds will all lose significantly compared to precious metals.

-

The banking system has been meticulously designed to seize your assets to buoy up a collapsing banking sector (see The Great Taking). You have ZERO counter party risk with precious metals.

Bateman posted an image of silver bars loaded onto heavy-duty pallets when he addressed his X followers about what he described as the trade of a lifetime.

Earlier today, shortly after silver jumped above $100. He posted on X, “Congrats everyone on $100 silver. Couldn’t have happened to a better group of degenerate mildly autistic misfits.”

Congrats everyone on $100 silver. Couldn’t have happened to a better group of degenerate mildly autistic misfits 🥂

— David Bateman (@davidbateman) January 23, 2026

Bateman’s trade could easily be up more than 250%, though he did not disclose his cost basis at the time. Either way, it stands out as one heck of a trade. As for readers who purchased zh coins and bars of gold and silver, the hedge has clearly paid off.

Loading recommendations…