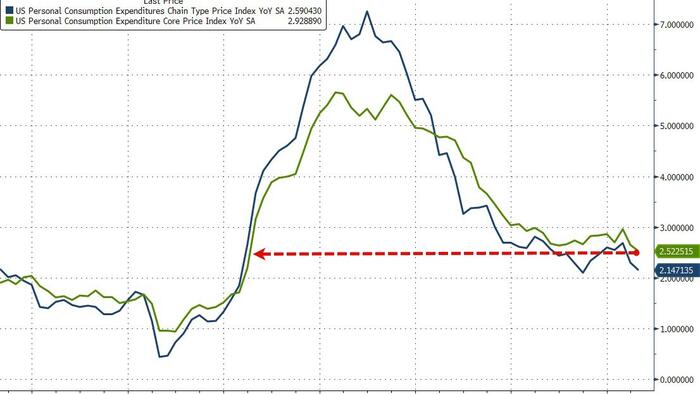

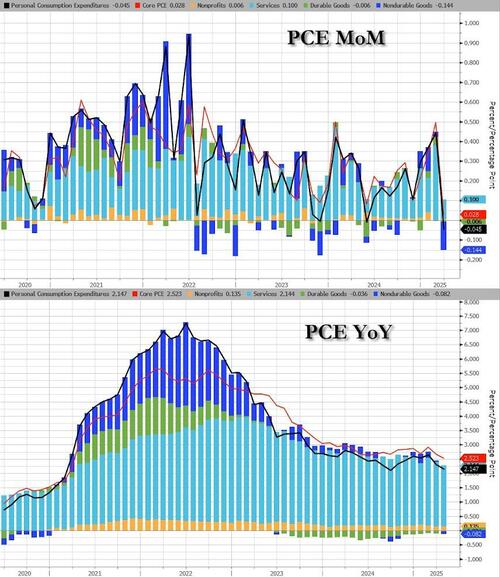

The Fed’s favorite inflation indicator – Core PCE – fell once again in April to its lowest since April 2021 at +2.5% YoY…

Source: Bloomberg

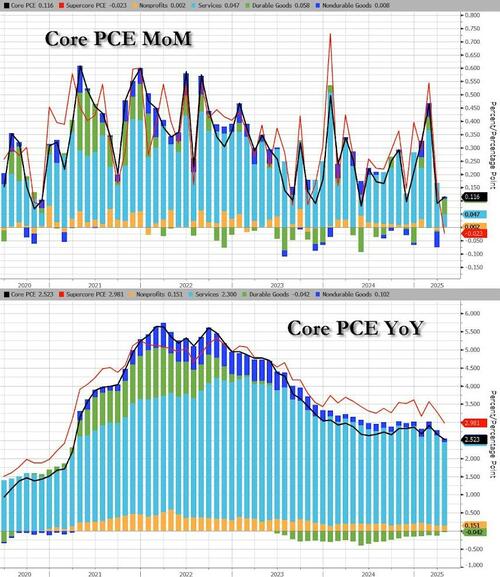

Services inflation is slowing rapidly…

Source: Bloomberg

Headline PCE fell to +2.1%…

Source: Bloomberg

The downturn was triggered by a large deflationary impulse in non-durable goods…

SuperCore PCE also tumbled to four year lows with its first MoM decline since April 2020…

Source: Bloomberg

SuperCore PCE was driven down by a big drop in Financial Services & Insurance costs…

Source: Bloomberg

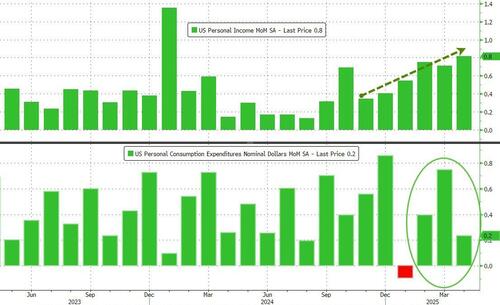

Finally, for all the terror of tariffs in the soft survey data, spending continues to increase and incomes are growing strongly…

Source: Bloomberg

On the income side, both govt and private workers saw compensation accelerate…

Source: Bloomberg

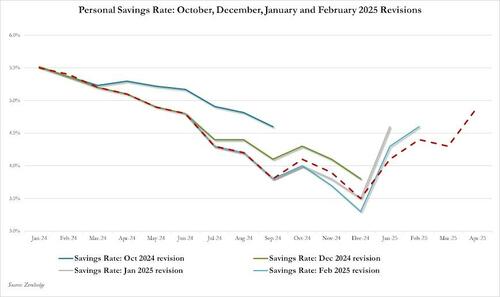

Given the outperformance of income over spending, the savings rate rebounded strongly to its highest since April 2024…

Source: Bloomberg

…it’s gonna be hard for Powell to justify the ‘pause’ now.

Loading…