![]() Michelle Bowman, the Federal Reserve’s vice chair of supervision, on Aug. 9 said that recent job data corroborates her concerns over labor market fragility and backs up her position that three interest rate cuts should be instituted this year.

Michelle Bowman, the Federal Reserve’s vice chair of supervision, on Aug. 9 said that recent job data corroborates her concerns over labor market fragility and backs up her position that three interest rate cuts should be instituted this year.

The other Fed Board of Governors member who dissented was Christopher Waller.

The Federal Reserve has appeared cautious about lowering interest rates, citing uncertainty over President Donald Trump’s tariffs and their impact on reaching the central bank’s 2 percent inflation target. However, in recent days, several Fed officials have appeared more sympathetic to cutting rates.

“Taking action at last week’s meeting would have proactively hedged against the risk of a further erosion in labor market conditions and a further weakening in economic activity,” Bowman said in comments to the Kansas Bankers Association.

Bowman’s remarks delved into her worries about a labor market downturn in more depth than what she expressed in a post-meeting explanation for her dissenting vote on interest rate cuts.

On Aug. 1, the Labor Department’s monthly employment report showed unemployment rising to 4.2 percent, with it “close to rounding up to 4.3 percent,” as Bowman described it in her Aug. 9 speech. There were also revisions to previously published data in the report, with job gains slowing significantly over the past three months, coming to a monthly average of 35,000.

“This is well below the moderate pace seen earlier in the year, likely due to a significant softening in labor demand,” Bowman said. “My Summary of Economic Projections includes three cuts for this year, which has been consistent with my forecast since last December, and the latest labor market data reinforce my view.”

The Fed has three policy meetings left this year, scheduled for September, October, and December.

A 100,000 monthly job gain would typically be seen by economists as consistent with a steady-state labor market.

Trump has been pushing for interest rate cuts all year and is scouting successors to Fed Chair Jerome Powell, whose term ends in May 2026. Waller, Bowman’s fellow dissenter, is reportedly being considered for the position.

On Aug. 9, Bowman said she had argued for a July interest rate cut at the Fed’s June meeting.

Trump fired the commissioner of the Bureau of Labor Statistics after the recent jobs report was published, calling the numbers “rigged.”

Bowman reiterated that she believes that major data revisions call for caution over heeding job-market reports too much, but she said on Aug. 9 that she sees “the latest news on economic growth, the labor market, and inflation as consistent with greater risks to the employment side of our dual mandate.”

Recent inflation data has also added to her position that Trump’s tariffs will not lead to long-term inflation, she said.

After omitting increases in goods prices related to tariffs, underlying inflation is “much closer” to the Fed’s 2 percent goal versus the official 2.8 percent measurement in June, based on the year-long change in the core personal consumption expenditures price index.

Bowman said she believes that the Trump administration’s tax cuts and deregulation will also offset any economic effects or price impacts from the tariffs.

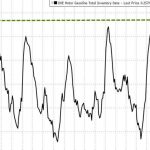

As housing demand is at its lowest since the financial crisis, and the labor market is not pushing up inflation, “upside risks to price stability have diminished,” Bowman said.

Shifting the Fed’s policy away from its current moderately constrained stance would “reduce the chance that the Committee will need to implement a larger policy correction should the labor market deteriorate further.”