Authored by Lance Roberts via RealInvestmentAdvice.com,

Bulls Remain In Control

The S&P 500’s close at 6,966 on Friday confirmed the market remains in a bullish uptrend, continuing the positive trajectory that began in mid‑2025. Price action this week gained traction and has been tracking the rising bullish trendline from the November lows, printing a new all-time high on Friday. Technical indicators remain bullish and not overbought with a momentum “buy signal” intact. However, weak money flows continue to suggest some caution below the surface.

The price remains above its major moving averages, with the index trading above both the 20-day and 50-day moving averages. This alignment has remained a hallmark of the market since the April 2025 lows, and retracements to those moving averages continue to find buyers.

Notably, market breadth improved early in the week as more stocks participated in the advance, reflecting a broader rally that extended beyond just mega-cap technology names. As noted above, value has gained some traction in recent weeks, and the number of S&P 500 constituents in positive territory has improved. However, despite the broader advance, a divergence remains, with fewer stocks leading the market higher. Divergences like this can signal internal weakening, even as the headline index reaches new highs.

Volatility measures also remain bullish with the VIX and related volatility gauges printing near historically low ranges, indicating that investors are not pricing large near-term swings. Low implied volatility tends to reflect complacency, but also underscores that significant breakouts or breakdowns have less feared market reaction priced in.

Overall, the S&P’s advance this week lacked strong momentum expansion, but the technical support remains intact, and the market’s inability to push convincingly to new highs suggests a battle between profit‑taking and fresh buying remains. This puts emphasis on key support levels, which will be critical for next week’s directional bias.

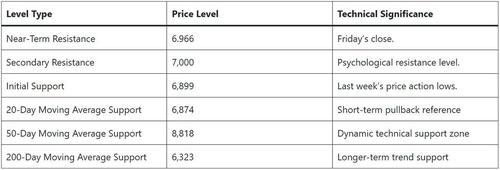

S&P 500 Technical Levels for Traders

Traders should view the 7,000–7,050 range as a key control zone for the market. If the index closes above this range with expanding volume, it increases the likelihood of continuation toward higher highs. Support at 6,900 is the first significant demand zone; loss of this area would expose the 50‑day average as a deeper test of trend integrity.

💰 Investor Lessons From 2025 For 2026

2025 reminded us of the many investor lessons that matter to surviving markets over the longer term. Some of those investor lessons were painful reminders during the “Liberation Day” sell-off, others were obvious, and some were just reminders of what we already knew. If you want to improve outcomes in 2026, you must absorb these investor lessons and implement them into your portfolio management practices.

Leave The Narratives For The Talking Heads

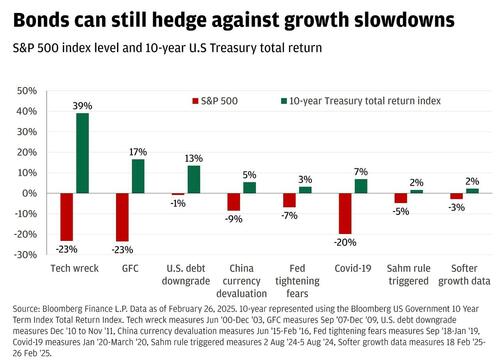

In 2025, numerous headlines predicted that interest rates would rise sharply, the “death of the dollar” was imminent, and tariffs would send inflation skyrocketing. None of those things happened, and Treasury bonds delivered positive returns for the year, with the broad index total return at approximately 7.08%. Given that bonds are often considered a“safe haven” during market turmoil, the investor lesson for 2026 is not to dismiss bonds as a risk diversifier when volatility arises.

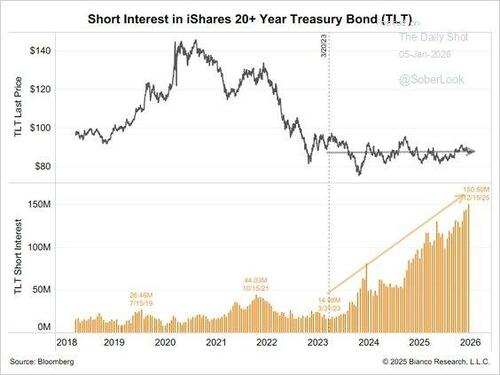

Such is particularly the case in 2026 as we enter the year with very elevated valuations and expectations, and a record level of short positioning against the 20+ Year Treasury Bonds ETF (TLT). The short position against Treasuries is most favored by arbitrageurs and hedgers, rather than long-term bets on rates. As Mark Hulbert for MarketWatch recently noted:

“Contrarian investors now believe bonds may outperform both stocks and gold because sentiment toward bonds is unusually pessimistic while optimism for stocks and gold is near historical highs, and history shows markets often rally after extreme pessimism and struggle after peak optimism, suggesting bonds could be a better bet in the months ahead despite strong 2025 performance in stocks and gold.”

As such, if Mark is correct, then any reversal that pushes money into safe-haven investments could cause an outsized move in yields, ie, higher bond prices, as short positioning is forced to cover. In other words, the odds favor the possibility that the consensus bets and narratives of 2025 could be out of favor in 2026.

Volatility Is Not Risk

Another valuable investor lesson in 2026 will be remembering that “risk” and “volatility” are not the same thing. Many investors equate volatility with risk, and as such, they panic sell at the first sign of a drop. Daily or even weekly market swings are not necessarily danger signs, as volatility is a normal part of the market cycle.

For example, 2025 experienced volatility, with stocks fluctuating up and down several times throughout the year. There were several spikes in the volatility index that had the “bears’ running for cover, proclaiming “AI was dead.” However, by the end of 2025, companies with strong earnings and solid cash flow held their value over time.

Risk is the permanent loss of capital. Volatility is price movement. While risk is certainly a byproduct of investing, the investor lesson for 2026 is to remember to hold quality assets, focus on fundamentals, and remember that volatility is the price of admission.

Cash Has Value

One of the worst narratives of 2025 was that “cash is trash.” The mistaken assumption was that investors buried their cash in the backyard, when in reality the majority of individuals have the cash in either higher-yielding money markets or invested in the asset markets. In either case, the rate of return on that cash exceeded the current U.S. inflation rate, protecting their purchasing power.

The investor lesson from 2025, and will remain in 2026, is that when markets do encounter periods of volatility, cash gives you options. Holding a higher level of cash in an uncertain environment hedges the portfolio against volatility, so investors are less likely to be forced into selling. Cash also provides “opportunity” by having purchasing power during market declines. As we discussed:

“Investors never face a choice of solely one investment over another. Instead, the goal is to invest in the correct asset at the correct time. When one is unsure, cash is a natural hedge against uncertainty. As many great investors throughout history state in one form or another: “The goal of investing is not only the ‘return ON my principal’ but also ensuring the ‘return OF my principal.’”

If I ignore the relevant risk, the outcome is that I will fall short of my financial goals. Importantly, I am not talking about being 100% in cash. Instead, I am suggesting that during periods of uncertainty, cash provides both stability and opportunity. Yes, cash will lose purchasing power over the holding period, but equities can lose a lot more when “fast risk” happens.

With the fundamental and economic backdrop becoming much more hostile toward investors in the intermediate term, understanding the value of cash as a “hedge” against loss becomes more important. Given the length of the current market advance, deteriorating internals, high valuations, and weak economic backdrop, reviewing cash as an asset class in your allocation may make some sense.”

In 2026, just as in 2025, you must allocate cash strategically. Cash is not dead money; it provides optionality, and you should consider holding enough to cover needs and seize opportunities.

Earnings Drive Long-Term Returns

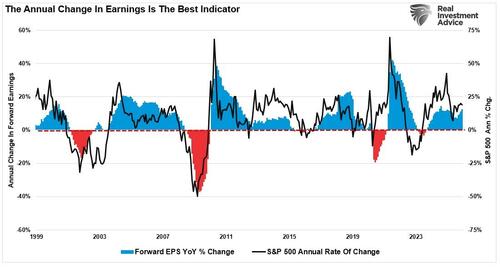

Investors chased momentum in 2025, buying low-quality companies with no earnings. In most cases, many of those investments have or will go bad, as earnings always matter in the end. The investor lesson for 2026 is that your focus must be on earnings growth and stability. Yes, price matters, but only in the short term. Ultimately, the market will track the annual rate of change in earnings.

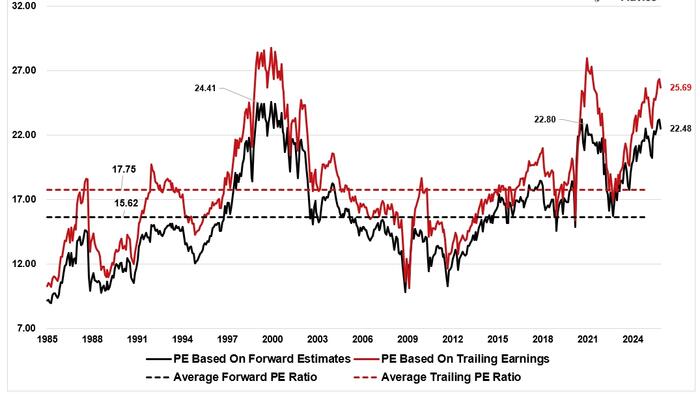

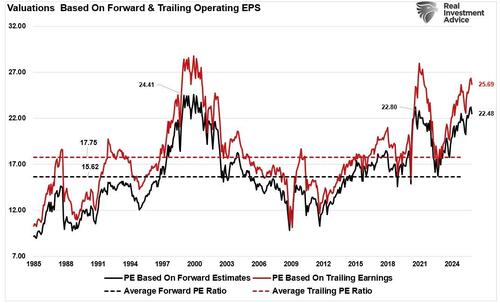

Of course, earnings are the “E” when considering valuations (P/E). With valuations elevated and forward returns expected to be lower, current expectations for another year of escalating earnings should likely be tempered.

Furthermore, given the overall sensitivity of earnings to economic growth, any slowdown in economic activity or employment in 2026 could become more problematic. With valuations and confidence elevated, investors should consider rebalancing portfolio risk to hedge against potential disappointment.

Your Plan Must Survive Stress

In 2025, many investors had plans until stress hit. Those plans changed rapidly when volatility unexpectedly struck in “all the wrong places.”

A notable example was the risk we repeatedly warned about in the options market, as reported by Morningstar:

“The options trader known as “Captain Condor” and his acolytes experienced a wipeout last week that incinerated tens of millions of dollars and cost some investors their life savings.

A strategy that had reliably produced winnings for the trader – whose real name is David Chau – and his group of roughly 1,000 investors went awry just before Christmas, saddling them with what was, by one count, a $50 million loss.

The fatal flaw – what finally caused Chau and his crew to lose most or all of their trading capital – was his use of the Martingale betting system. In the Martingale system, the bettor doubles down after each loss, hoping to recoup their money and then some. After a streak of mounting losses, Chau and his followers risked it all on Christmas Eve and saw the last of their capital wiped out as the S&P 500 SPX tallied a record closing high.

Some members of Chau’s group lost hundreds of thousands of dollars – most of their life savings – according to account statements reviewed by MarketWatch. One member launched a GoFundMe page soliciting donations to help cover basic living expenses.

While this is just one story among many, the investor lesson for 2026 is that whatever your investment plan is, it must include rules for buying, selling, risk control, and, most crucially, the protection of your investment capital.

The reason is simple: If you lose all of your capital, you are out of the game.

The investor lesson for this year is to test your plan against bad scenarios. Testing your plan against adverse outcomes will allow you to survive volatility without panic. Ultimately, a plan fosters discipline, and discipline safeguards capital.

Rebalancing Works

Most investors treat rebalancing like flossing. In other words, they know they should do it, but they wait until something hurts. For example, in 2025, those who adhered to a disciplined rebalancing strategy achieved stronger returns and lower risk than those who didn’t. The problem is that avoiding rebalancing leads to an unbalanced, or lopsided, portfolio that becomes systemically exposed to sharp corrections.

Rebalancing is a simple and painless process. When one part of your portfolio grows faster than others, it becomes too large a share of your total. That shift subtly changes your risk exposure without your consent. The investor lesson is not to let “greed” override the rebalancing process. When tech stocks surge, it becomes easy to “let it ride,” hoping they will become an even larger position in the portfolio. However, as noted above, the risk is that it becomes a concentrated bet. Concentrated bets work great as long as markets are rising, but eventually they will revert.

In 2025, tech surged early, then corrected sharply, and then soared again into the year-end before stalling. Those who rebalanced sold some of those gains in March, bought them back in April, and trimmed again as the year wrapped up. That shift added performance, reduced portfolio volatility, and enabled investors to navigate market volatility without panic. Rebalancing is not about guessing what wins next. It’s about managing risk while buying what’s undervalued and trimming what’s overextended.

How you rebalance your portfolio is up to you, but you do need rules to follow. Some rebalance on a regular schedule (monthly, quarterly or semiannually). We prefer thresholds such as when a position grows to represent more than 5% of the portfolio value, or is significantly larger than its target weight in the portfolio.

Most importantly, the investor lesson is that rebalancing works because it imposes discipline. It forces you to sell high and buy low. In 2026, that discipline will likely matter again as the market will tend to surprise you.

Key Catalysts Next Week

U.S. financial markets enter the second full week of January with a spotlight on inflation, producer costs, labor trends, and Federal Reserve guidance. Data flow is expected to pick up after the December jobs report, released last Friday, showed weaker payroll gains and raised renewed questions about the health of the labor market. Markets are weighing whether slower hiring reduces inflationary pressures or signals broader economic weakness. Recent labor data underscore a cooling of job growth and elevated uncertainty surrounding future Fed policy.

Economic releases this week will influence expectations for interest rates, corporate earnings forecasts, and risk assets. The Consumer Price Index (CPI) and the Producer Price Index (PPI) are among the most market‑sensitive releases. CPI will gauge whether consumer inflation is decelerating enough to influence the Fed’s pace of future rate adjustments. PPI will offer insight into the underlying cost pressures facing businesses. The Beige Book from the Federal Reserve will provide narrative detail on regional economic activity and pricing trends ahead of the late‑January FOMC meeting on the 27th and 28th. Market participants will parse this report for signs of tightening or easing conditions across the economy.

The overall market direction this week will hinge on whether inflation measures indicate a durable downtrend or a stubborn rebound. Any surprises in CPI, PPI, or labor indicators will drive volatility in equities, rates, and the U.S. dollar.

Thinking Ahead

As we head into 2026, the investor lessons outlined above will be crucial for navigating the market. Most notably, the mindset of investors must shift from forecasting or hoping for higher market returns to focusing on risk management. Markets are unpredictable, and as such, most predictions in 2025 fell short, even from seasoned professionals. That’s not a flaw in the market; it’s a flaw in overconfidence. You cannot control outcomes, but you can control your approach.

That starts with a margin of safety. Every investment should be made below fair value, with a cushion for mistakes, downturns, or bad luck. While investors escaped with overpaying in 2025, the question is whether they will be as lucky in 2026. Maybe they will, but the odds are increasing they won’t. Therefore, holding cash reserves, avoiding leverage, and prioritizing capital protection over chasing gains will be a winning formula.

Furthermore, you must be honest about your time horizon. Many investors claim to be long-term but will bail out at the first drawdown. Long-term investing means enduring volatility without flinching. If you lack the skill and systems to trade short-term, stop pretending. Focus on quality assets, reasonable prices, and a strategy you can live with in good times and bad.

Lastly, remember that the market punishes arrogance and rewards discipline. The pain of 2025 wasn’t random; it was a reminder. If you lost money, those losses came with a lesson. Don’t ignore it. In 2026, stay humble. Follow your rules, know your risks, protect your capital, and stick to fundamentals.

The reality is that the market will shift again; it is only a function of time. Therefore, your job is to stay ready, not reactive.

Loading recommendations…