Stocks are set to recoup some of Friday’s tech-driven losses, with a big week of data releases ahead, as the last full week of 2025 comes witgh a bang. Still, sentiment seems a little shaky, with rising signs of skepticism over AI and debate about the extent of rate cuts next year. As of 8:00am ET, S&P 500 futures and Nasdaq 100 contracts both rose 0.5% after Friday’s 1.1% cash market slump in which technology sector fell 2.9%. In premarket trading, Nvidia leads Mag 7 gains, climbing 1.1% with the rest of the group largely in the green. European stocks climbed 0.8%. 10-year Treasury yields ticked lower and the dollar index traded at session lows as the yen surged on renewed bets the BOJ would hike rates this week. Bitcoin rallied 1.3% to $89,652, adding to signs that risk sentiment is steadying. Today’ key events include the December Empire manufacturing (8:30am) and NAHB housing market index (10am). Major releases later this week include November CPI Thursday. Fed speakers include Governor Miran (9:30am, 11am) and New York Fed’s Williams (10:30am).

In premarkt trading, Nvidia climbs 1.1% and is among leaders of a rebound in Magnificent Seven stocks after the group suffered a two-day drop amid concern over elevated spending and delays for projects tied to AI (Tesla +1.4%, Alphabet +0.7%, Amazon +0.4%, Apple +0.1%, Meta little changed, Microsoft is little changed).

- Mining stocks are higher amid a renewed advance in metals prices.

- Adobe (ADBE) slips 1.3% and ServiceNow (NOW) falls 4% after the pair were downgraded to underweight at Keybanc, which sees AI tools bringing a bigger hit to both software firms.

- Dole (DOLE) climbs less than 1% on light trading after the produce company agreed to sell port and port operations in Guayaquil, Ecuador, for $75m in cash.

- Entegris Inc. (ENTG) falls 2% after Goldman Sachs cut its recommendation on the semiconductor materials company to sell from neutral on slow wafer recovery.

- GXO Logistics (GXO) declines 2.2% after the logistics company said Brad Jacobs will step down as non-executive chairman of the board, effective Dec. 31.

- Immunome (IMNM) soars 27% after the biotech company announced positive topline results from its Phase 3 trial of varegacestat.

- iRobot (IRBT) falls 72% after the company filed for bankruptcy and proposed handing over control to its main Chinese supplier.

- Teradyne (TER) gains 3% after Goldman Sachs upgraded its recommendation to buy from sell, seeing an AI-driven demand uplift for the manufacturer of chip-testing equipment.

- ZIM Integrated Shipping (ZIM) rises 4% after Calcalist reported that MSC has submitted a bid to purchase the Israeli shipping company, without saying where it got the information.

In corporate news, Roomba maker iRobot filed for bankruptcy and proposed handing over control to its main Chinese supplier. Korea Zinc plans to build a smelter in the US at an estimated cost of around $7.4 billion, backed by investments from the American government, to produce key materials used in chip-making, defense and aerospace.

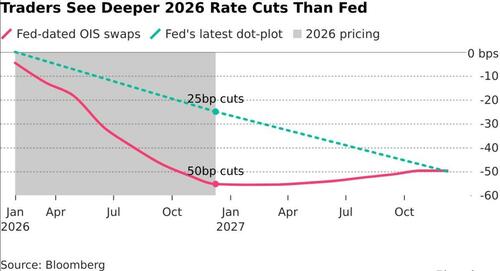

Traders are looking to delayed jobs and inflation data this week to help fill the void left by the US government shutdown as they build a picture on the economy and interest rates. Citigroup joined the upbeat chorus on the outlook for US stocks next year, while Morgan Stanley’ Michael Wilson wrote that the “good is bad/bad is good” trade is back, and weak jobs data on Tuesday could boost stocks as it would raise the probability of more rate cuts. The jobs number will also be critical for bond traders, who are betting on two rate cuts next year — one more reduction than the Fed is indicating.

“We are now firmly back into a good is bad/bad is good regime,” Morgan Stanley strategist Michael Wilson wrote in a note. “Moderate” weakness in the labor market weakness “Is likely to be received in a bullish context by equity markets,” he said.

Citi strategists led by Scott Chronert said they expect robust earnings growth will deliver a 13% rally next year for the S&P 500. That implies double-digit gains for a fourth year running, and echoes optimistic forecasts by banks including Morgan Stanley, Deutsche Bank and Goldman. “We anticipate an incremental shift from AI enablers to adopters/users in 2026, setting the stage for increased productivity improvement commentary across corporates,” Chronert wrote. “A generally supportive Fed is a key assumption in our playbook.”

Economists project a 50,000 increase in nonfarm payrolls and a 4.5% unemployment rate, consistent with a sluggish, but not rapidly deteriorating, labor market (our full preview will hit later today). The US data will help answer the question entering 2026 of whether the Fed is close to being done easing, after three straight cuts, or if it has to move more aggressively.

“We had the debate around closing our equities overweight, but we don’t believe the trend is yet ending,” said Philipp Lisibach, head of strategy and research at LGT Private Banking. “Exposure to AI continues to be rewarded, while rates and credit remain relatively unattractive. Equities still offer the most compelling risk-reward trade.”

As for the AI giants themselves, the debate among investors is whether to rein in exposure ahead of a potential bubble popping or double down on the game-changing technology. One big worry is rising depreciation expenses from the data center binge. Alphabet, Microsoft and Meta combined for about $10 billion in depreciation costs in 4Q 2023. That figure rose to nearly $22 billion in 3Q this year, and it’s expected to be about $30 billion by this time next year.

A final flurry of major central bank policy decisions is also due, with meetings at the Bank of England, the ECB and the Bank of Japan, among others. National Economic Council head Kevin Hassett said he’d consider Trump’s policy opinions if he’s picked to lead the Fed, but rate decisions would stay independent. And Ukraine and the US are due to hold a second day of talks in Berlin on Monday about a plan aimed at ending Russia’s war, with allied security guarantees for Kyiv a central focus of the negotiations.

In Europe, Stoxx 600 trades higher by 0.8%. Consumer stocks outperform on signs of better Chinese demand, while the health-care sector underperforms. Here are some of the biggest movers on Monday:

Juventus shares rise as much as 14%, the most in more than a year, after the Agnellis family’s investment vehicle Exor NV rejected an unsolicited bid by Tether Holdings to acquire the Italian football club.

- Kering climbs as much as 4%, leading luxury stocks higher, after China vowed to increase financial support for key consumption areas.

- Puma shares also rise as much as 4% on the news that China will strengthen coordination between the commerce and financial sectors to boost consumption.

- Argenx shares fall as much as 9.7%, the most in more than seven months, after the biotechnology company discontinued its late-stage studies into thyroid eye disease.

- Sanofi shares sink as much as 6.4% after its experimental multiple sclerosis drug got hit with two setbacks: a regulatory delay in the US as well as a failure in a late-stage clinical trial.

- Rheinmetall leads European defense firms down, with its shares as much as 3.1% lower, after Ukrainian President Volodymyr Zelenskiy said he could accept security guarantees from the US and Europe instead of NATO membership amid ongoing peace talks.

- Truecaller shares plummet as much as 29%, the most since 2023 and to a record low, after the Swedish caller ID platform guided for its 4Q ad revenues around 30% lower year-on-year.

- Schweiter Technologies shares fall as much as 14%, hitting their lowest level since 2005, after the maker of composite panels issued a profit warning that Zurcher Kantonalbank says was a surprise.

Elsewhere, Chinese indexes edged lower after the latest data showed retail sales growth was the weakest since Covid, while investment slumped further. Asian shares also dropped, tracking Wall Street’s losses on Friday, with South Korea — a poster child for AI exuberance — slipping 1.8%.

In FX, the Bloomberg Dollar Index is down 0.2% with the yen top of the G-10 leaderboard ahead of an expected BOJ rate hike on Friday. Kiwi lags after RBNZ Governor Breman pushed back on investor bets over a rate hike next year.

In rates, treasury futures held small gains accumulated during European morning as the region’s bonds advanced. Global bond yields also lean lower. Gilt prices outperform 10-year equivalents from the US and Germany with the BOE set to cut rates by 25bps on Thursday. US yields are 1.5bp to 2.5bp richer across the curve with front-end tenors lagging slightly, flattening 2s10s spread by around 1bp. 10-year near 4.16% is 2.3bp lower on the day, slightly outperforming German and UK counterparts. IG dollar bond issuance slate empty, with this week expected to be the final window for any companies looking to raise capital in the debt markets before year-end. Treasury auctions this week include $13 billion 20-year bond reopening Wednesday and $24 billion 5-year TIPS Thursday. The week is packed with US economic data releases, including the delayed November jobs report on Tuesday.

In commodities, crude oil prices are now lower after failing to hold onto opening gains. Fed rate-cut bets also helped lift the price of gold on Monday. The yellow metal climbed for a fifth day to around $4,345 an ounce, approaching a record high; silver outperforms, higher by 2.9%. Bitcoin gains 1.5%.

US economic calendar includes December Empire manufacturing (8:30am) and NAHB housing market index (10am). Major releases later this week include November CPI Thursday. Fed speakers include Governor Miran (9:30am, 11am) and New York Fed’s Williams (10:30am).

Market Snapshot

- S&P 500 mini +0.5%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini +0.7%

- Stoxx Europe 600 +0.8%

- DAX +0.5%

- CAC 40 +1%

- 10-year Treasury yield -2 basis points at 4.16%

- VIX +0.6 points at 16.37

- Bloomberg Dollar Index -0.1% at 1205.59

- euro little changed at $1.1745

- WTI crude -0.2% at $57.35/barrel

Top Overnight News

- Affordability pressures are weighing heavily on the White House heading into next year’s midterm elections. They’re also offering cautious hope in Mexico and Canada that the U.S. won’t abandon its trilateral trade pact as the three countries enter a high-stakes review. Politico

- Trump is reportedly not certain his economic policies will translate to midterm wins, while he said his US investments haven’t fully taken effect and stated that by the time they have to talk about the election, which is in another few months, he thinks their prices are in good shape: WSJ

- White House economic adviser Hassett said he would consider US President Trump’s policy opinions, but added that the central bank would remain independent if he were to become the next Fed chair: BBG

- Apollo Management took bets against technology companies vulnerable to AI, in which it is betting against several large loans to software makers and cutting exposure to the sector, according to FT.

- SpaceX is moving forward with an insider share sale that values it at about $800 billion, setting up what could be the largest initial public offering of all time. WSJ, BBG

- Volodymyr Zelenskiy signaled Ukraine may step back from its long-term goal of joining NATO if it can secure bilateral security agreements with the US, Europe and other states. It’s holding a second day of talks with the US in Berlin. BBG

- Fannie and Freddie have snapped up more than $50 billion of home loans as Trump administration officials seek to drive down mortgage rates. BBG

- The European Commission is expected on Tuesday to reverse the EU’s effective ban on sales of new combustion-engine cars from 2035, bowing to intense pressure from Germany, Italy and European automakers struggling against Chinese and U.S. rivals. EV makers say reneging on ban would yield more ground to China. RTRS

- China’s economic momentum slowed broadly in November, with a marked weakening in consumer spending, adding pressure on Beijing to stabilize household and business demand in the world’s second-largest economy. Retail sales (+1.3% vs. the Street +2.9% and vs. +2.9% in Oct), industrial production (+4.8% vs. the Street +5% and vs. +4.9% in Oct), and investment (both fixed asset investment and property investment deteriorated in Nov). WSJ

- Vanke, one of China’s largest real-estate companies, made a renewed effort to muster bondholder backing for an onshore debt repayment due this week and avoid a default after the state-backed developer’s plan was rejected, rekindling concerns about the nation’s crisis-hit property sector. RTRS

- Japanese companies seem keen to raise wages again next year, despite many bracing for a tariff hit to profits, a central bank report shows days ahead of its next policy meeting. The findings will likely reinforce expectations that the central bank will raise interest rates to 0.75% from 0.5% this week. WSJ

- BoJ officials are likely to start selling the central bank’s pile of exchange-traded funds as early as next month, according to people familiar with the matter, a process expected to take decades to complete. RTRS

Trade/Tariffs

- US and Mexico reportedly struck a deal on Friday to settle the Rio Grande water dispute, which eases the bilateral tensions which had been stoked after US President Trump’s threat of an additional 5% tariff on Mexico if it did not provide additional water to help US farmers.

- China’s Central Financial and Economic Affairs Commission Deputy Director said they will expand exports and increase imports in 2026.

- China’s Customs allows dairy import products from Norway.

- An Indian Trade Official said India is engaging with Mexico on higher tariffs to protect its own trade interests. Said Mexico’s primary target is not to hit Indian exports.

- India has proposed a “preferential trade agreement” with Mexico.

- India’s Trade Secretary said India and the US are close to a “framework” deal but won’t give a timeline.

- EU plans a crackdown on very dangerous Chinese products sold on online platforms, including Alibaba (9988 HK) and Shein, according to FT.

- France said conditions for an EU vote on a Mercosur deal are not yet met, despite recent progress, while France calls for the EU-Mercosur December meeting to be pushed back to continue work on mirror clauses.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly pressured at the start of a risk-packed week and following on from the tech-led declines stateside amid a rotation out of AI, while participants digested economic releases, including the BoJ Tankan and Chinese activity data. ASX 200 retreated with the declines led by mining, materials, resources and tech sectors, with the mood in Australia also sombre following a terror attack on Bondi Beach targeting a Jewish celebration. Nikkei 225 underperformed ahead of a widely anticipated BoJ rate hike later this week, while the quarterly BoJ Tankan survey showed sentiment of Large Manufacturers was at the highest in four years, which supports the case for a rate hike. Hang Seng and Shanghai Comp were subdued after the latest Chinese activity data disappointed and house prices continued to contract, with tech and biotech leading the declines in Hong Kong, while losses in the mainland were contained after reports that China is to issue ultra-long-term special government bonds in 2026 to fund major national strategies and security initiatives, as well as large-scale equipment upgrades and consumer goods trade-in programs.

Top Asian News

- China is to issue ultra-long-term special government bonds in 2026 to fund major national strategies and security initiatives, as well as large-scale equipment upgrades and consumer goods trade-in programs.

- China stats bureau spokesperson said China’s economy stabilised and improved in November, but the impact of changes in the external environment has deepened, and the conflict between strong domestic supply and weak demand is prominent. The spokesperson also noted that some industries and firms face difficulties, while authorities will step up counter-cyclical and cross-cyclical adjustments. Furthermore, it was stated that household consumption capability and confidence need to be further improved, with efforts to be made to stabilise jobs, boost income growth, and release consumption potential.

- China Vanke’s (2202 HK) proposal for a one-year delay of repayment for a bond due December 15th was rejected by bondholders, which leaves a five-day grace period to make the CNY 2bln bond payment and avoid a potential default.

- Hong Kong’s Democratic Party voted on Sunday to dissolve amid pressure from Beijing and previous alleged threats of severe consequences, including possible arrest if they did not disband, according to The Guardian.

- BoJ is likely to begin selling its ETF holdings as soon as January, according to Bloomberg.

- RBNZ Governor Breman said the economic outlook has evolved broadly in line with expectations, and the forward path for the Official Cash Rate published in the November monetary policy statement indicates a slight probability of another rate cut in the near term. However, she added that if economic conditions evolve as expected, the official cash rate is likely to remain at its current level of 2.25% for some time. Breman also commented that there continues to be signs that growth is recovering and financial market conditions have tightened since the November decision, beyond what is implied by the central projection for the OCR.

- BoK said NPS agrees to extend its currency swap agreement for another year, with Bloomberg reporting that the NPS is to take a flexible approach to strategic FX hedging.

- China NPC Standing Committee to hold a meeting between December 22-27. NPC Standing Committee to review draft revision to foreign trade law.

European bourses (STOXX 600 +0.7%) opened on a stronger footing and traded at elevated levels throughout the morning. Upside, which comes despite a broadly lower APAC session, where Chinese stocks were subdued after the latest Chinese activity data disappointed. European sectors are broadly in the green, with a cyclical bias as Autos leads whilst Healthcare underperforms; the latter has also been dragged down by losses in Sanofi (-4%) after the Co. flagged delays in an FDA decision for Tolebrutinib.

Top European News

- Swiss SECO forecasts: US Tariff reduction has strengthened outlook 2025. Sees 2025 GDP (sports adj.) at +1.4% (prev. exp. +1.3%). Sees CPI +0.2% (prev. exp. +0.2%). 2026. Sees GDP (sports adj.) +1.1% (prev. exp. +0.9%). Sees CPI at +0.2% (prev. exp. +0.5%) 2027. Sees GDP (sports adj.) +1.7%. Sees CPI at +0.5%.

- UK’s OFCOM launches a probe into BT (BT/ LN) and Three, following UK-wide outages in the summer

FX

- G10s are mixed against the Dollar with clear outperformance in the JPY, whilst the Kiwi lags vs the USD after RBNZ’s Bremen said that the forward path for the official cash rate published in the November monetary policy statement indicates a slight probability of another rate cut in the near term.- DXY is a touch lower on the day, but likely a function of JPY strength (see below). No specific macro catalysts for the greenback as the week kicks off, but late on Friday, US President Trump said he was leaning towards Kevin Warsh or Hassett to lead the Fed. DXY trades within 98.29-98.48 parameters. The session is likely to focus on commentary from Fed’s Miran, expected to explain his dissent in last week’s FOMC meeting, while the influential Williams will speak on economic growth.

- JPY is the clear outperformer in the G10 FX space, where the BoJ is set to raise rates for the first time since January 2025. Japan’s Tankan survey overnight bolstered the case for a hike in Friday’s meeting, where the reading suggested overall business sentiment improved in Q4 and inflation expectations stood pat at 2.4% for the 1, 3, and 5-year horizons. Markets currently assign a c. 80% probability that the BoJ lifts rates by 25bps on Friday. USD/JPY began trundling lower after hitting the psychological 166 level, and 21DMA at 155.96, to a session low of 154.96.

- PBoC set USD/CNY mid-point at 7.0656 vs exp. 7.0569 (Prev. 7.0638)

Fixed Income

- USTs are currently firmer today by a handful of ticks, and reside at the upper end of a 112-06 to 112-12 range. Overnight trade saw US paper saunter higher, but lacked a clear driver – no hints provided from a yield perspective either, with rates lower to a similar magnitude across the board. Markets now await Fed speak from Miran and Williams, and the former is expected to release an explanation of his dovish dissent last week. Then the focus will turn to key US data in the coming days, namely NFP and CPI.

- Bunds are also in the green, albeit to a lesser extent than peers; currently within a 127.45 to 127.64 confine. Earlier, German Wholesale Sales M/M printed in-line with expectations, whilst Y/Y rose from the prior; the inner report pinned the rise to “higher prices of food, beverages and tobacco”. Elsewhere, focus has been on geopolitics whereby Zelensky suggested that Ukraine is willing to drop NATO membership ambitions, in favour of security guarantees. Negotiations between Ukrainian and US officials will continue in Germany later today.

- Gilts also gain in today’s session, in line with peers. Nothing really much from a UK perspective this morning, aside from UK Rightmove House Prices, which continued to show contractions. An exec at the firm said, “with market conditions supporting higher levels of activity, and a hopefully more certain economic environment, we forecast a better year for price growth in 2026 with a strong rebound in activity to kickstart the year”. The docket is very thin from a UK perspective, but will pick up starting from tomorrow, where a slew of key data will precede a BoE rate decision on Thursday.

Commodities

- WTI and Brent initially started the week positively following better Chinese demand, but have failed to sustain a bid higher, as US envoys meet with European and Ukrainian officials in Berlin. Benchmarks dipped to a trough of USD 57.32/bbl and USD 61.07/bbl, respectively, at the start of the APAC session, before gradually bidding higher to a high of USD 57.62/bbl and USD 61.50/bbl. Despite the improved Chinese oil demand and reports of Iran seizing a foreign tanker, benchmarks have fallen into the European open and are currently trading near session lows.

- Spot XAU has started the week on the front foot as ETF flows, central bank buying, and XAG short squeeze continue to support the yellow metal. After Friday’s liquidation selloff to a trough of USD 4257/oz, XAU bounced in the latter part of last week. The yellow metal opened at USD 4304/oz and gradually trended higher throughout the APAC session and thus far, remains at session highs of USD 4350/oz with ATHs just c. USD 30/oz away.

- 3M LME Copper, among most markets, got caught up in the tech-led selloff on Friday but has rebounded as the European session gets underway. Despite the selloff on Friday, ANZ analysts note that “demand for the metal continues to beat expectations despite the fall in China’s economic growth”, adding that the bank is bullish with the expectation that the market will move further into a deficit in 2026.

- India’s November gold imports at USD 4.02bln (prev. USD 14.7bln); oil imports at USD 14.12bln (prev. USD 14.8bln).

- Russia’s Nornickel sees a global nickel surplus at more than 200KT in 2025 and 2026, sees the global Palladium market balanced in 2025, sees a deficit at 0.2 MoZ, including investments.

- The US asks the EU to exempt US gas from methane law obligations until 2035.

Geopolitics: Middle East

- Israel’s military conducted a strike on Gaza, which killed senior Hamas commander Raed Saed, while the Israeli military said it put a planned strike on a southern Lebanon site on hold after the Lebanese Army requested access.

- Two US Army soldiers and a civilian US interpreter were killed in Syria, while the Syrian government said the attacker was a member of Syrian security forces with extremist views. It was later reported that US President Trump said they will retaliate against ISIS and that there will be a lot of damage done to the people who attacked the troops in Syria.

Geopolitics: Ukraine

- US President Trump said a lot of progress is being made on Russia and Ukraine, while he responded that they don’t want it now, and it would be complex when asked about the idea of a free economic zone in the Donbas region.

- Ukrainian President Zelensky said services have been working to restore electricity, heating and water supply to regions following Russian strikes on energy infrastructure. Zelensky also commented that there won’t be a peace plan that everyone will like and there will be compromises, while he also stated that US and European security guarantees, instead of NATO membership, are a compromise from Ukraine’s side and that security guarantees should be legally binding.

- Ukrainian presidential adviser said Ukraine and US teams meeting on peace proposals in Berlin lasted more than five hours on Sunday and will continue on Monday, while US special envoy Witkoff said a lot of progress was made during the talks.

- Ukrainian military said it struck a Russian oil refinery in the Krasnodar region and a Russian oil depot in the Volgograd region, while Ukraine’s Navy said a Russian drone attack hit a Turkish civilian vessel carrying sunflower oil to Egypt on Saturday.

- Russian Defence Ministry said Russian forces captured Varvarivka in Ukraine’s Zaporizhzhia region, according to RIA.

- EU’s Kallas said new sanctions on Russia’s shadow fleet will be decided today. Adds that the EU has delivered 2mln artillery rounds to Ukraine this year. Will not leave the EU summit without a decision on funding for Ukraine.

- Lithuania’s Foreign Minister said he expects the EU to widen the Belarus sanctions regime to include hybrid activity. Ukraine needs something like Article 5 in terms of security guarantees, with a nuclear deterrent.

- Russia’s Kremlin said Ukraine not joining NATO is a key question but subject to special discussion. Expects the US to update Russian officials on the proposals from the Berlin talks.

- Washington reportedly still wants Ukraine to cede the Donbas region to Russia, via Sky News Arabia citing official familiar with the negotiations.

Geopolitics: Other

- US envoy John Coale said Belarusian President Lukashenko agreed to do all he can to stop weather balloons flying into Lithuania, while Coale also stated that the US will remove sanctions on Belarusian potash and that around 1,000 remaining political prisoners in Belarus could be released in the coming months.

- US President Trump said land strikes against Venezuela will start happening and don’t necessarily have to be in Venezuela.

- US President Trump said on Friday that he had a very good conversation with the Thai and Cambodian PMs, while he added that they agreed to cease all shooting effective that evening and go back to the original peace accord. However, it was reported over the weekend that Thailand’s PM Charnvirakul said his country has not reached a ceasefire agreement with Cambodia and the Thai military will continue fighting on the disputed border.

- Philippine Coast Guard said three Filipino fishermen were wounded and two fishing boats suffered significant damage from high-pressure water cannon blasts by Chinese Coast Guard ships in the South China Sea, while it called on China’s Coast Guard to adhere to internationally recognised standards of conduct.

- China sanctioned the former chief of staff of the Japan Self-Defense Forces, in which it froze properties, prohibiting transactions with, and barring visas for former Japanese official Iwasaki.

US Event Calendar

- 8:30 am: Dec Empire Manufacturing, est. 10, prior 18.7

- 10:00 am: Dec NAHB Housing Market Index, est. 39, prior 38

- Central Banks (All Times ET):

- 9:30 am: Fed’s Miran Delivers Talk on Inflation Outlook

- 10:30 am: Fed’s Williams delivers Keynote Remarks

- 11:00 am: Fed’s Miran Appears on CNBC

DB’s Jim Reid concludes the overnight wrap

We’ve launched our big 2026 Global Financial Market Survey with many questions on your views for the year ahead. It includes, after a two-year gap, asking you your favourite Xmas song. Where you think the S&P 500 or Mag-7 ends up creates nothing like the controversy of the announcing your favourite Xmas song. You can complete the survey here. It closes on Wednesday. All help filling in very much appreciated.

Welcome to the last full week of the year. It’s started with me sneezing, eyes watering and completely bunged up. The flu? No! Just a kids Xmas party last night where unbeknownst to me they had a cat. I’m very allergic to them. The cat actually had the right idea and had already left for the evening due to the noise. Sadly, I had to endure the noise and the cat’s airborne residue.

So not the greatest start to the week for me and just when you thought it was safe to wind down for Christmas, the coming week is shaping up to be a significant one for global markets, with a dense calendar of economic releases and major central bank decisions. The European Central Bank, the Bank of England and the Bank of Japan all have a chance to be Scrooges or Santas in their meetings this week. Alongside these announcements, the data flow will be heavy: the US will finally publish delayed employment and inflation reports, while flash PMIs for December and will provide clues on global momentum.

It’s also an interesting time for global markets with long-end yields at or around multi-month or even multi-year highs (e.g. Japan and 30yr Europe) at the same time as the weakest AI stories are increasingly being punished rather than the pre-September period when AI all went up together. If that wasn’t enough, another notable Fed story came late on Friday, as President Trump suggested that NEC Director Kevin Hassett and former Fed Governor Kevin Warsh were his two favoured candidates for the Fed Chair role. Hassett has been viewed as the frontrunner in recent weeks but following Trump’s interview his Polymarket odds fell from around 73% late on Friday to 52% this morning. Warsh has gone from 13% before the interview to 40% this morning. So, it’s fair to say there’s a lot of unfinished business going into the last full trading week of the year.

For this week specifically, in the United States, attention will centre on tomorrow’s twin employment reports for October and November, delayed by the recent government shutdown. October’s headline payrolls are expected to show a decline of around -60k (DB forecasts here and below), largely due to federal layoffs with all the early year buy-out offers coming off payroll in October. November should rebound modestly with a gain of +50k (DB). Private sector hiring is likely to remain steady in both months at around +50k (DB), slightly below the recent trend. The unemployment rate is forecast to rise to 4.5 per cent in November from 4.4 per cent in September (we will never know October), while average hourly earnings should increase by 0.3 per cent in both months, keeping year-on-year nominal compensation growth near 4.4 per cent. Hours worked are expected to stabilise at 34.3. Given the distortions caused by the shutdown, the household survey could be noisy, echoing patterns seen after the 2013 episode. For a cleaner read on labour market conditions, Thursday’s jobless claims will be important and given our economists believe this will come in at around +225k, they believe underlying hiring trends remain intact.

Inflation will also be in focus with Thursday’s US CPI release. Because October data were not collected, the report will centre on year-on-year changes. Headline CPI is expected to hold broadly steady at 3.03%, while core inflation remains at 3.02%. Monthly headline gains across October and November should average +0.24%, slightly below September’s pace with core slightly above at +0.26%. Within the details, core goods prices are likely to show modest increases in household furnishings and apparel, while used car prices continue to decline. Core services will attract particular attention, especially rents, which are expected to rebound after September’s anomalous weakness. Airline fares and lodging should soften from their recent highs, though health insurance may surprise on the upside. Beyond jobs and inflation, Tuesday’s retail sales report will offer insight into consumer spending. We anticipate a headline decline of -0.3%, driven by autos and lower fuel prices, but retail control—the component used in GDP calculations—should rise by +0.3%, signalling resilience in underlying demand. Friday’s final reading of University of Michigan consumer sentiment is expected at 54.0, with inflation expectations likely to matter more than the headline figure.

On policy, last week’s FOMC meeting delivered a 25bps rate cut and signalled a “wait and see” approach. Chair Powell struck a dovish tone, emphasising labour market risks over inflation. This week’s Fedspeak will reinforce that message, with Governor Miran and New York Fed President Williams speaking today, followed by Governor Waller and Williams again on Wednesday. Atlanta Fed President Bostic closes the week on Friday. Miran, who dissented in favour of a larger cut, is expected to reiterate his view that shelter inflation will collapse in coming quarters.

In Europe, Thursday brings a cluster of central bank decisions. The ECB is expected to keep rates unchanged at 2 per cent (see our econ preview here), while the Bank of England is forecast to deliver its sixth cut of the cycle, lowering Bank Rate to 3.75 per cent on a narrow 5-4 vote. See our economist’s preview here. The Riksbank and Norges Bank will also decide on policy on the same day with both likely to stay on hold. Ahead of the BoE meeting, UK labour market data on Tuesday and CPI on Wednesday will be closely watched. Headline inflation is forecast to ease to 3.51% year-on-year, while core ticks up slightly to 3.46% (see our economist’s preview here). Retail sales and consumer confidence on Friday will round out the UK calendar. In Germany, the Ifo survey on Wednesday and consumer confidence on Friday will provide further insight into regional conditions as fiscal spending starts to ramp up. Across the Atlantic, Canadian inflation is out today which is interesting given the sharp move from pricing in a slightly easing bias earlier this month to almost a full hike by the end of 2026 now.

Across Asia, the Bank of Japan meets on Friday and is expected to raise rates by 25bps to 0.75 per cent, with a 94% probability priced in by markets. See our economist’s thoughts here. Japan’s nationwide CPI for November will also be released on Friday, with core inflation forecast to slow to 2.9% and core-core to 3.0%. Global flash PMIs for December, covering the US, UK, Japan, Germany and France, will be published tomorrow and will offer early signals on fourth-quarter growth trends.

Asian equity markets have kicked off the week notably lower after a difficult US session on Friday. Across the region, tech-focused exchanges are the poorest performers, with the KOSPI (-1.34%) and the Nikkei (-1.36%) leading the losses, followed by the Hang Seng (-1.15%). Mainland Chinese stocks are outperforming a bit due to less AI exposure and after a series of disappointing economic indicators (details below) may be raising stimulus odds. The CSI (-0.41%) and the Shanghai Composite (-0.31%) registering minor losses due to reduced exposure to the global AI market. The S&P/ASX 200 (-0.72%) is also trading lower. S&P 500 (+0.31%) and NASDAQ 100 (+0.24%) are both bouncing back a bit though.

Returning to China, the economic slowdown intensified in November, with retail sales increasing by only +1.3% last month compared to the same period last year, significantly below Bloomberg’s forecast of +2.9% growth, and a decrease from the +2.9% rise recorded in the previous month. Industrial production rose by 4.8% in November year-on-year, falling short of the anticipated 5% increase and marking the weakest growth since August 2024. Business investment remained weak in November, with fixed asset investment declining by -2.6% year-on-year, exceeding expectations of a -2.3% drop. This decline has worsened from the -1.7% decrease observed from January to October, representing the most significant downturn since the pandemic began in 2020. A separate report indicated that new home prices in China continued to fall, decreasing by -0.39% m/m in November, compared to a -0.5% decline in the previous month, suggesting that we’re still waiting for a recovery in demand even with government assurances that they will stabilise the sector.

Recapping last week now and US equities saw a mixed week, with the S&P 500 reaching a new all-time high on Thursday but slumping by -1.07% on Friday to end the week -0.63% lower. Concerns about the sustainability of AI-related spending weighed on tech with the NASDAQ down by -1.62% (-1.69% Friday) and the Mag-7 by -1.86% (-0.75% Friday). Oracle (-12.69%, -4.47% Friday but rallying off the day’s lows) and Broadcom (-7.77%, -11.43% Friday) plunged after their earnings reports. But there was rotation towards more blue-chip stocks, with the Dow Jones (+1.05%, -0.51% Friday) holding onto a sizeable weekly gain.

The rates space saw a significant curve steepening as the FOMC delivered a third consecutive 25bp cut. While the Fed signalled a possible pause in early 2026, dovish hints supported 2026 rate cut expectations. Fed fund pricing for December 2026 was little changed over the week but down by -7.4bps from its peak on Tuesday, with 56bps of rate cuts now priced for 2026. The next cut is 54% priced by March. Front-end Treasury yields declined, with the 2yr yield falling by -3.8bps to 3.52% (-1.8bps Friday). By contrast, the 10yr yield (+4.9bps to 4.18%; +2.7bps Friday) and the 30yr yield (+5.3bps to 4.84%; +4.5bps Friday) both posted their highest levels since September, bringing the 2s10s slope to its steepest since January 2022, just before the Fed started its post-Covid hiking cycle. Meanwhile, recent money market tightness eased as the Fed also announced the commencement of reserve-management purchases of Treasury bills.

In Europe, government bonds sold off amid rising global term premia and hawkish comments by the ECB’s Isabel Schnabel. 10yr bund yields rose +5.9bps to 2.86%, their highest weekly close since March, with OATs (+5.3bps) and BTPs (+6.3bps) similarly higher. The OAT outperformance came as the French parliament approved the social security budget. In the equity space, Friday’s -0.53% decline left the STOXX 600 little changed on the week (-0.09%).

Germany’s DAX (+0.66%, -0.45% Friday) outperformed, in part helped by a Bloomberg report that German lawmakers are set to approve €52bn in defence orders next week, with Rheinmetall climbing +5.66% as a result. In the UK, the FTSE 100 (-0.19%, -0.56% Friday) wasn’t helped by a soft monthly GDP reading on Friday (-0.1% vs +0.1% expected). Meanwhile, European credit outperformed the US, with HY spreads tightening by -1bps in contrast to a +11bps widening across the Atlantic.

In commodities, Brent crude prices fell -4.13% to $61.12/bbl, to within one dollar of their 2025 lows seen back in May. In contrast, gold rose by +2.43% to $4,300/oz as investors returned to safe haven assets. Bitcoin (+1.12% on the week) managed to reclaim the $90,000 level despite a -2.89% decline on Friday.

Loading recommendations…