Today’s Retail Sales data is for December and so should be ‘clean’ from the perspective of the January storms which dramatically reduced consumers ability to spend year-to-date, as illustrated by BofA’s ‘rest of US’ spending indicator…

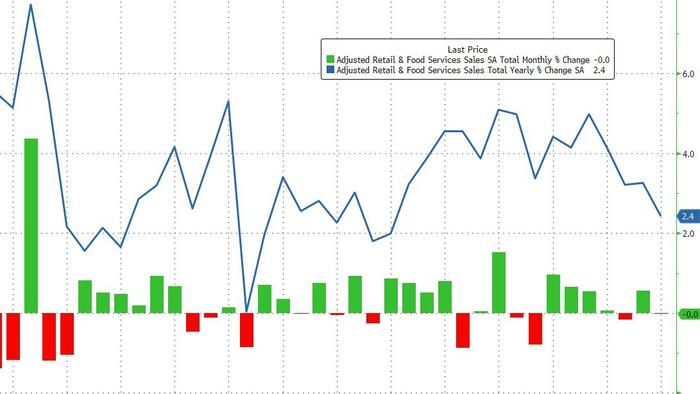

After a big bounce in November, expectations were for a decent 0.4% MoM rise in retail sales to end the year (despite the plunge in consumer confidence signaled by UMich), but the actual print was a big disappointment with headline retail sales unchanged MoM in December. That is the weakest YoY retail sales growth since Sept 2024…

Source: Bloomberg

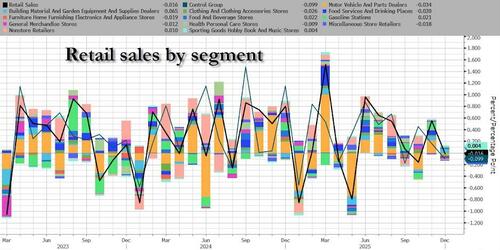

Motor Vehicle and Clothing sales tumbled the most while spending on Building Materials and Food & Beverage rose the most…

Core Retail sales was also unchanged MoM (a big miss from ther +0.4% MoM exp)…

Worse still the ‘Control Group’ which plugs into the GDP calculation, fell 0.1% MoM (far worse than the 0.4% MoM expected).

Of course, this December disappointment comes after a strong November so before you panic, perhaps some smoothing and seasonals are at play.

Interestingly, ‘real’ retail sales (admittedly crudely adjusted via CPI) actually decline on a YoY basis in December…

Perhaps it’s time for this alligator’s mouth to snap shut?

Source: Bloomberg

In addition to disappointing retail spending, sentiment among US small-business owners edged down in January for the first time in three months as optimism about the economic outlook eased. The NFIB Optimism index slipped 0.2 point to 99.3, with 7 of the 10 components that make up the gauge decreased, while three increased.

Taxes continued to rank as the single most important problem for small firms, followed by quality of labor.

However, a net 16% of owners said they expect inflation-adjusted sales to improve in the next three months, up 6 percentage points from December and the largest share in a year. Also, a net 15% of owners reported that now would be a good time to expand their business, a six-month high.

Loading recommendations…